Using the data from M12-6, calculate the maximum investing cash inflows that could be reported under IFRS.

Question:

Using the data from M12-6, calculate the maximum investing cash inflows that could be reported under IFRS. Using data from M12-7, calculate the maximum financing cash flows that could be reported under IFRS.

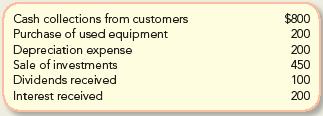

Data From M12-6:

Based on the following information, compute cash flows from investing activities under GAAP.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

Sure based on the image you sent the data for M126 is Description Amount Cash collections from custo...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Accounting

ISBN: 978-0078025914

5th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby

Question Posted:

Students also viewed these Business questions

-

Using the data from M12-6, calculate the maximum investing cash inflows that could be reported under IFRS. Using data from M12-7, calculate the maximum financing cash flows that could be reported...

-

Using the data from M12-6, calculate the maximum investing cash inflows that could be reported under IFRS. Using data from M12-7 calculate the maximum financing cash flows that could be reported...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

P Corporation acquired an 80% interest in S Corporation two years ago at an implied value equal to the book value of S. On January 2, 2017, S sold equipment with a five-year remaining life to P for a...

-

Are estate income taxes the responsibility of the estate or its beneficiaries?

-

The payroll records of Wailee Company provided the following information for the weekly pay period ended March 23, 2018: Required 1. Enter the relevant information in the proper columns of a payroll...

-

When valuing minority interests in private companies, should appraisers normalize earnings? a. If yes, what kinds of normalizing adjustments should be made? b. What is the objective of making...

-

The Ajax Coal Company is the only employer in its area. It can hire any number of female workers or male workers it wishes. The supply curve for women is given by Lf = 100wf MEf = Lf =50 and for men...

-

The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reportsthe number of courses and the...

-

For the following two independent cases, show the cash flows from operating activities section of the statement of cash flows for year 2 using the indirect method.

-

Prestige Manufacturing Corporation reports the following items in its statement of cash flows presented using the direct method. Indicate whether each item is disclosed in the operating activities...

-

Consider a small car of mass 1200 kg and a large sport utility vehicle (SUV) of mass 4000 kg. The SUV is traveling at the speed limit (v = 35 m/s). The driver of the small car travels so as to have...

-

Prepare the entries to record the transaction 2 A company has three employees, each of whom has been employed since January 1 earns $2750 per month and is paid on the last day of each month On March...

-

Pet Emporium had a robbery on the weekend in which a large amount of inventory was taken. The loss is covered completely by insurance. A physical inventory count determined that the cost of the...

-

In a test taken by a class of 50 students, the average was 1500 with a standard deviation of 40. What 2 scores capture the middle 60% of the students?

-

For questions 1-8, let P = (-2, 5) and Q = (4,8). 1. Find the distance from the point P to the point Q. 2. Find the midpoint of the line segment joining P and Q. 3. Find the slope of the line PQ. 4....

-

True/False Indicate whether the statement is true or false. ____ 1. In accounting, to value means to record a transaction or event. ____ 2. The recognition issue deals with when a business...

-

If a multivariate function has continuous partial derivatives, the order in which the derivatives are calculated does not matter. Thus, for example, the function f(x, y) of two variables has equal...

-

Determine the annual percentage yield for a loan that charges a monthly interest rate of 1.5% and compounds the interest monthly.

-

Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations, ending December 31, 2017. To simplify this exercise, the amounts given in the...

-

The following is a list of accounts and amounts reported for Empire Inc., for the fiscal year ended December 31, 2017. The accounts have normal debit or credit balances and the dollars are rounded to...

-

Ninja Sockeye Star prepared the following unadjusted trial balance at the end of its second year of operations, ending December 31, 2017. Other data not yet recorded at December 31, 2017 includes the...

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App