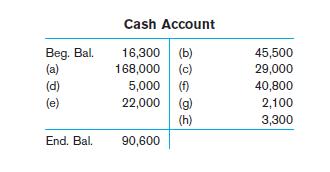

Analysis of the Cash Account The following information, in T-account format, is provided for Mars Company for

Question:

Analysis of the Cash Account The following information, in T-account format, is provided for Mars Company for the year 2009:

Additional information:

a. Sales revenue for the period was $164,000. Accounts receivable (net) decreased $4,000 during the period.

b. Net purchases of $48,000 were made during 2009, all on account. Accounts payable increased $2,500 during the period.

c. The equipment account increased by $21,000 during the year.

d. One piece of equipment that cost $8,000, with a net book value of $4,000, was sold for a $1,000 gain.

e. The company borrowed $22,000 from its bank during the year.

f. Various operating expenses were all paid in cash, except for depreciation of $2,400.

Total operating expenses were $43,200.

g. Interest expense for the year was $1,800. The interest payable account decreased by $300 during the year.

h. Income tax expense for the year was $4,200. The income taxes payable account increased by $900 during the year.

Required:

1. From the information given, reconstruct the journal entries that must have been made during the year (omit explanations).

2. Prepare a statement of cash flows for Mars Company for the year ended December 31, 2009.

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain