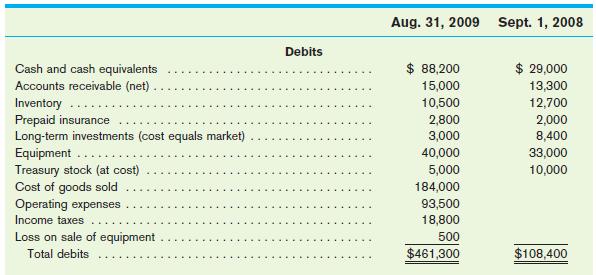

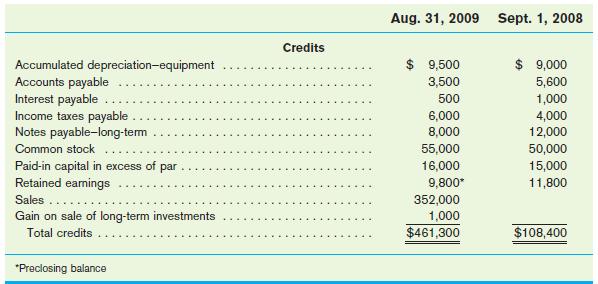

Analyzing the Cash Position of Good Time, Inc. The following data show the account balances of Good

Question:

Analyzing the Cash Position of Good Time, Inc.

The following data show the account balances of Good Time, Inc., at the beginning and end of the company’s fiscal year:

The following information concerning this year was also available:

a. All purchases and sales were on account.

b. Equipment with an original cost of $5,000 was sold for $1,500; a loss of $500 was recognized on the sale.

c. Among other items, the operating expenses included depreciation expense of $3,500; interest expense of $1,400; and insurance expense of $1,200.

d. Equipment was purchased by issuing common stock and paying the balance ($6,000)

in cash.

e. Treasury stock was sold for $2,000 less than it cost; the decrease in stockholders’ equity was recorded by reducing Retained Earnings.

f. No dividends were paid this year.

You are to examine Good Time’s cash position by:

1. Preparing schedules showing the amount of cash collected from accounts receivable, cash paid for accounts payable, cash paid for interest, and cash paid for insurance.

2. Preparing a statement of cash flows for Good Time for the fiscal year 2009 using the direct method.

3. Identifying the major reasons why Good Time’s cash and cash equivalents increased so dramatically during the year.

4. Comment on whether the dividend policy seems appropriate under the current circumstances.

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain