Budgeting, Control, and C-V-P Analysis Livingston, Padden, & Company (LPC) makes specialized compact discs that are used

Question:

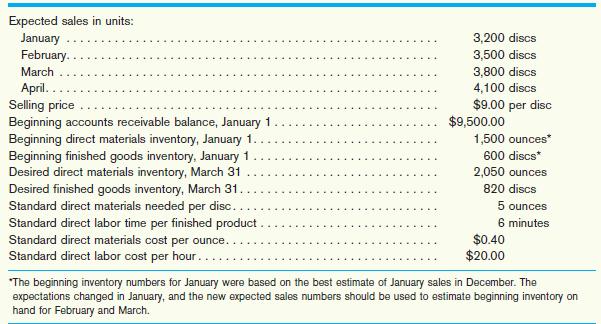

Budgeting, Control, and C-V-P Analysis Livingston, Padden, & Company (LPC) makes specialized compact discs that are used for high-density data storage. LPC forecasts an increase of 300 units per month in sales for the first two quarters of the year. The following data are available for the company:

Additional information:

• Of a month’s sales, 60% is collected by month-end; the remaining 40% is collected the following month.

• The desired finished goods inventory each month is 20% of the next month’s sales.

• The desired direct materials inventory every month is 10% of next month’s production needs.

Required:

1. Using the standard costs for making the discs, prepare the following:

a. Sales budgets for January, February, and March (in dollars).

b. Cash collections budgets for January, February, and March (in dollars). Assume that all sales are on credit.

c. Production budgets for January, February, and March (in units).

d. Direct materials usage budgets for January, February, and March (in ounces).

e. Direct materials purchases budgets for January, February, and March (in ounces).

f. Direct labor budgets for January, February, and March (in dollars).

2. Assume that actual usage of direct materials to make the discs was 41⁄2 ounces at a cost of $0.50 per ounce. Compute the materials price and quantity variances for each month (compute the quantity variance based on the amount of direct materials used).

3. Assume that actual labor costs to make the discs were 5 minutes of labor at a cost of $22 per hour. Compute labor rate and efficiency variances for each month. (Note:

round calculations to the nearest whole dollar.)

4. Assume that Gonzales is able to make the discs at the standard costs for materials and labor and that the standard fixed costs per month are $15,000 (there are no variable overhead costs). How many compact disks (CDs) will Gonzales need to sell each month in order to break even? If Gonzales raised its price per CD from $9 to $10, how many CDs will need to be sold in order to break even?

5. Assuming again that Gonzales is able to make the discs at its standard costs, if sales decrease by 500 discs during the three months at the increased price of $10 per disc, should Gonzales raise its price?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain