Estimating Inventory Jon Johnson, an accountant with a local CPA firm, has just completed an inventory count

Question:

Estimating Inventory Jon Johnson, an accountant with a local CPA firm, has just completed an inventory count for Mom & Pop’s Groceries. Mom and Pop provide audited financial statements to their bank annually, and part of that audit requires an inventory count. Don Squire, a partner with the CPA firm, has also conducted an analysis to estimate this period’s ending inventory. Don used the gross margin method, a method whereby the prior period’s gross margin percentage is used to infer this period’s percentage, to estimate ending inventory. In addition, the store is equipped with cash registers that scan each product as it is sold and, as a result, provide a perpetual inventory record.

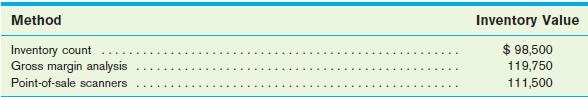

These three inventory analysis methods have resulted in three very different answers, which are summarized in the following table:

In evaluating the results, Jon and Don are curious as to why the three methods result in such large differences. Since the inventory count reports actual inventory on hand, they begin to wonder if Mom and Pop have an inventory theft problem. Write a short memo explaining why the other two methods, gross margin analysis and point-of-sale scanners, can result in significantly different answers without there being a theft problem.

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain