Estimating Uncollectible Accounts Ulysis Corporation makes and sells clothing to fashion stores throughout the country. On December

Question:

Estimating Uncollectible Accounts Ulysis Corporation makes and sells clothing to fashion stores throughout the country. On December 31, 2009, before adjusting entries were made, it had the following account balances on its books:

Required:

1. Make the appropriate adjusting entry on December 31, 2009, to record the allowance for bad debts if uncollectible accounts receivable are estimated to be 3% of accounts receivable.

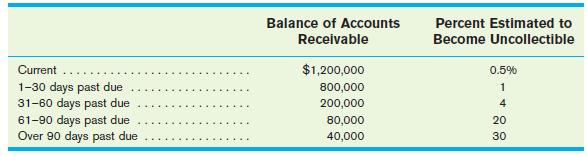

2. Make the appropriate adjusting entry on December 31, 2009, to record the allowance for bad debts if uncollectible accounts receivable are estimated on the basis of an aging of accounts receivable; the aging schedule reveals the following:

3. Now assume that on March 3, 2010, it was determined that a $64,000 account receivable from Petite Corners is uncollectible. Record the bad debt, assuming:

a. The direct write-off method is used.

b. The allowance method is used.

4. Further assume that on June 4, 2010, Petite Corners paid this previously written-off debt of $64,000. Record the payment, assuming:

a. The direct write-off method had been used on March 3 to record the bad debt.

b. The allowance method had been used on March 3 to record the bad debt.

5. Interpretive Question: Which method of accounting for bad debts, direct write-off or allowance, is generally used? Why?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain