Manufacturing Overhead Allocation Using Activity-Based Costing Ricks Crane Company manufactures three different crane engines with 50 horsepower

Question:

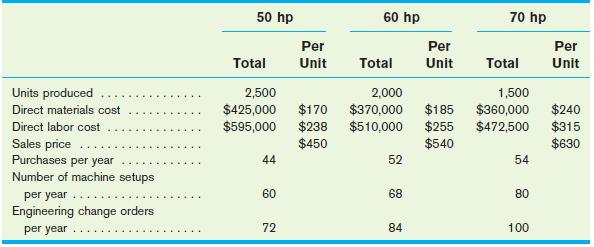

Manufacturing Overhead Allocation Using Activity-Based Costing Rick’s Crane Company manufactures three different crane engines with 50 horsepower (hp), 60 horsepower, and 70 horsepower engines, respectively. Relevant information for each engine is provided as follows:

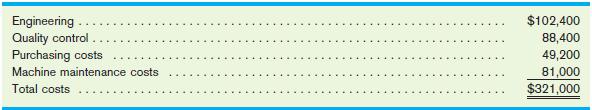

Total manufacturing overhead cost pools:

Required:

Required:

1. Determine the gross margin for each product allocating manufacturing overhead costs on the basis of production volume (units produced).

2. Identify appropriate allocation bases for each of the four pools of manufacturing overhead costs.

3. Determine the ABC allocation rates for each of the four cost pools suggested in part (2).

4. Using the allocation bases suggested in part (2), determine manufacturing overhead costs per product.

5.

a. Determine the gross margin per product using the manufacturing overhead costs determined in part (4).

b. Interpretive Question: Which of the methods (unit-based costing or activity-based costing) is the better method to allocate the manufacturing overhead costs?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain