Personal Budgeting Kathy Bourne is an advertising specialist for Success Advertising, Inc. Her annual salary is $42,000,

Question:

Personal Budgeting Kathy Bourne is an advertising specialist for Success Advertising, Inc. Her annual salary is

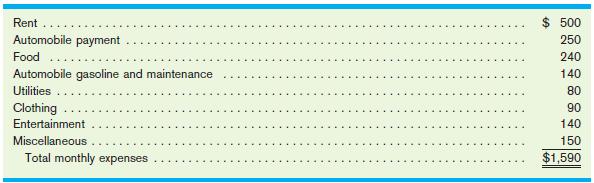

$42,000, of which 20% is withheld for federal income taxes, 7% for state income taxes, 7.65% for FICA taxes, and 5% for a tax-sheltered annuity. She estimates that her monthly expenses are approximately as follows:

Required:

1. Prepare Kathy’s monthly budget, assuming that the car payments will continue for about three years.

2. Assume that Kathy would like to accumulate savings of $12,000 in order to take an extended leave from her job. This will allow her to travel and take courses as a way of generating some fresh ideas she can use in creating new approaches to advertising.

How long will it take her to save the needed amount? (Ignore interest earnings, and assume that she has no savings at the present time.)

3. Interpretive Question: If Kathy asked you for advice on how she might reduce her expenses, what would you suggest?

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain