Unifying Concepts: Property, Plant, and Equipment Logan Corporation owns and operates three sawmills that make lumber for

Question:

Unifying Concepts: Property, Plant, and Equipment Logan Corporation owns and operates three sawmills that make lumber for building homes.

The operations consist of cutting logs in the forest, hauling them to the various sawmills, sawing the lumber, and shipping it to building supply warehouses throughout the western part of the United States. To haul the logs, Logan has several trucks. Relevant data pertaining to one truck are:

a. Date of purchase, July 1, 2007.

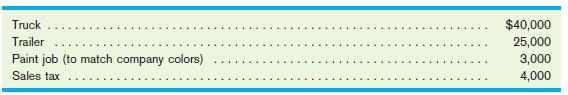

b. Cost:

c. Estimated useful life of the truck, 120,000 miles.

d. Estimated salvage value, zero.

e. 2008 expenditures on truck:

(1) Spent $4,500 on tires, oil changes, greasing, and other miscellaneous items.

(2) Spent $18,000 to overhaul the engine and replace the transmission on January 1, 2008. This expenditure increased the life of the truck by 85,000 miles.

Required:

Record journal entries to account for:

1. The purchase of the truck.

2. The 2007 depreciation expense using units-of-production depreciation and assuming the truck was driven 35,000 miles 3. The expenditures relating to the truck during 2008.

4. The 2008 depreciation expense using the units-of-production method and assuming the truck was driven 50,000 miles.

Step by Step Answer:

Accounting Concepts And Applications

ISBN: 9780324376159

10th Edition

Authors: W. Steve Albrecht, James D. Stice, Earl K. Stice, Monte R. Swain