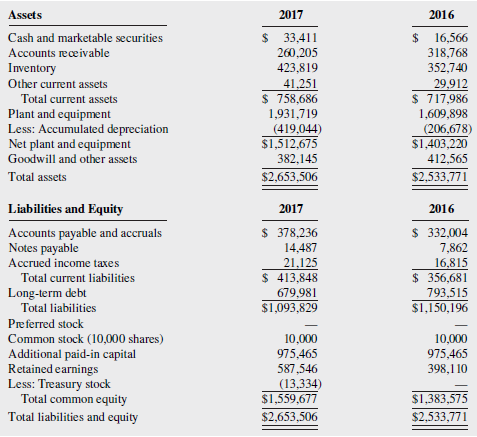

Analysts following the Tomkovick Golf Company were given the following balance sheet information for the years ended

Question:

In addition, it was reported that the company had a net income of $3,155,848 and that depreciation expenses were equal to $212,366 during 2017. Assume amortization expense was $0 in 2017.

a. Construct a 2017 cash flow statement for this firm.

b. Calculate the net cash provided by operating activities for the statement of cash flows.

c. What is the net cash used in investing activities?

d. Compute the net cash provided by financing activities.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Assets 2017 2016 $ 33,411 16,566 318,768 352,740 Cash and marketable securities %24 Accounts receivable 260,205 Inventory 423,819 41,251 $ 758,686 Other current assets 29,912 $ 717,986 Total current assets Plant and equipment Less: Accumulated depreciation Net plant and equipment Goodwill and other assets 1,931,719 (419,044) $1,512,675 1,609,898 (206,678) $1,403,220 412,565 382,145 $2,653,506 $2,533,771 Total assets Liabilities and Equity 2017 2016 $ 378,236 14,487 $ 332,004 7,862 16,815 $ 356,681 Accounts payable and accruals Notes payable Accrued income taxes 21,125 $ 413,848 679,981 $1,093,829 Total current liabilities Long-term debt Total liabilities 793,515 $1,150,196 Preferred stock 10,000 Common stock (10,000 shares) 10,000 975,465 398,1 10 Additional paid-in capital Retained earnings Less: Treasury stock Total common equity 975,465 587,546 (13,334) $1,559,677 $1,383,575 Total liabilities and equity $2,653,506 $2,533,771

Step by Step Answer:

a Tomkovick Golf Company Statement of Cash Flows Year Ended June 30 2017 Operating Activities Net in...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Analysts following the Tomkovick Golf Company were given the following information for the years ended June 30, 2013 and June 30 2012: Construct a 2013cash flow statement for this firm. Calculate the...

-

It was reported that Exabyte Corporation, a fast growing Colorado marketer of backup tape drives, has decided to purchase key components of its product from others. For example, Sony Corporation of...

-

In October 2010 it was reported that Cheryl Eckard, a quality-assurance manager at the pharmaceutical company Glaxo-SmithKline who had blown the whistle on the safety of products made in its Puerto...

-

You are an audit supervisor of PricewaterhouseCoopers (PwC) and are planning the audit of your client, Blister Pharmaceuticals co. which manufactures and imports sanitary and cleaning products...

-

An accounting clerk for Westwind Co. prepared the following bank reconciliation: a. From the bank reconciliation data, prepare a new bank reconciliation for Westwind Co., using the format shown in...

-

Explain why it is not possible to prepare m-bromochlorobenzene or p-nitrobenzenesulfonic acid by carrying out two successive electrophilic aromatic substitutions.

-

Why is the fashion calendar different for luxury and high street fashion? LO.1

-

Supreme Auto Parts produces components for motorcycle engines. It has plants in Amarillo, Texas, and Charlotte, North Carolina, and supply factories in Detroit and Atlanta. Production and cost data...

-

O True False Question 7 A PAP may be canceled at any time for any reason if the insurance company no longer wants to insure you. O True O False Question 8 0. Juilo ir $7.259. To repair the damages...

-

Mity-Lite (ML) is a manufacturer of folding and stackable chairs and folding tables for social events. The demand for ML's products is seasonal, peaking in spring and summer. Suppose it is December...

-

Vanderheiden Hog Products Corp. provided the following financial information for the quarter ending June 30, 2017: Net income: $189,425 Depreciation and amortization: $63,114 Increase in receivables:...

-

Based on the financial statements for Tomkovick Golf Company in Problem 3.32, compute the cash flow invested in net working capital and the cash flow invested in long-term assets that you would use...

-

Recruiting a Dual-Career Manager. Companies often consider dual-career couples to be a major problem when selecting candidates for global assignments. How would you recruit a top manager for a global...

-

Everyone at some point has had issues with time management and procrastination in their work life, academic life and social life. How have you been handling time management issues in your life? Have...

-

You want to make three peanut butter and jelly sandwiches. What is the best way to make them that's consistent with an agile mindset? Create a sandwich assembly line, applying all the peanut butter...

-

1 pts Joan Reed exchanges commercial real estate that she owns for other commercial real estate, plus $50,000 cash. The following additional information pertains to this transaction: Property given...

-

It is believed that 86% of Padres fans would have liked Trevor Hoffman to remain in San Diego to finish out his career as a San Diego Padre. You would like to simulate asking 10 Padres fans their...

-

The videos below cover why American higher education, including public colleges and universities, is so expensive. They also explore factors that have resulted in the current student loan debt...

-

Internal capital markets have several limitations. When a firm is confronted by these limitations, what is it likely to do?

-

Distinguish between the work performed by public accountants and the work performed by accountants in commerce and industry and in not-for-profit organisations.

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Q1) The equity of Washington Ltd at 1 July 2020 consisted of: Share capital 500 000 A ordinary shares fully paid $1 500 000 400 000 B ordinary shares issued for $2 and paid to $1.50 600 000 General...

-

out The following information relates to Questions 1 to 2. The management accountant of a furniture manufacturer is developing a standard for the labour cost of one massage chair. When operating at...

-

Exercise 10-8 Utilization of a constrained Resource [LO10-5, L010-6] Barlow Company manufactures three products: A, B, and C. The selling price, variable costs, and contribution margin for one unit...

Study smarter with the SolutionInn App