Asset W has an expected return of 12.8 percent and a beta of 1.25. If the risk-free

Question:

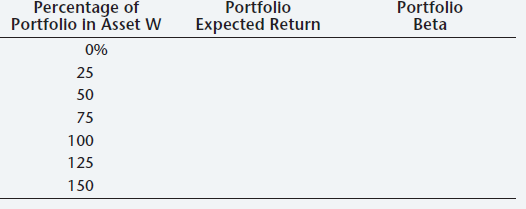

Asset W has an expected return of 12.8 percent and a beta of 1.25. If the risk-free rate is 4.1 percent,

complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected

return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted: