Consider the following income statement for the Heir Jordan Corporation: A 20 percent growth rate in sales

Question:

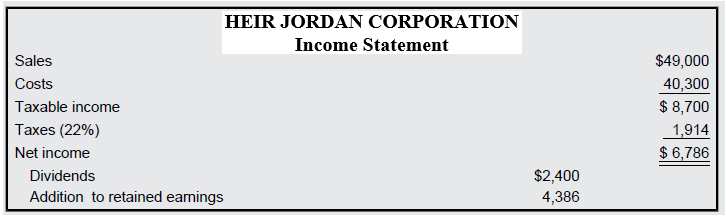

Consider the following income statement for the Heir Jordan Corporation:

A 20 percent growth rate in sales is projected. Prepare a pro forma income statement assuming costs vary with sales and the dividend payout ratio is constant. What is the projected addition to retained earnings?

Transcribed Image Text:

HEIR JORDAN CORPORATION Income Statement Sales $49,000 40,300 Costs Taxable income Taxes (22%) Net income Dividends Addition to retained earnings $ 8,700 1,914 $ 6,786 $2,400 4,386

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

Assuming costs vary with sales and a 20 percent incr...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Question Posted:

Students also viewed these Business questions

-

Based on the following information, calculate the sustainable growth rate for Kalebs Heavy Equipment: Profit margin = 7.3% Capital intensity ratio = .80 Debt equity ratio = .95 Net income = $73 , 000...

-

A firm wishes to maintain an internal growth rate of 7.1 percent and a dividend payout ratio of 25 percent. The current profit margin is 6.5 percent, and the firm uses no external financing sources....

-

For each of the following, compute the present value: Interest Rate Present Value Future Value $ 16,832 Years 13 4 29 9% 48,318 886,073 13 21 40 550,164

-

Assume that n is a positive integer. For each of the following algorithm segments, how many times will the innermost loop be iterated when the algorithm segment is implemented and run? 1) for k:=1 to...

-

For each invertible matrix in the prior problem, use Corollary 4.11 to find its inverse. Corollary 4.11 The inverse for a 2 Ã 2 matrix exists and equals if and only if ad - bc 0. a b c d d -b...

-

Over long periods of time, the rate of return of an average investment in the stock market has exceeded the return on high-quality bonds. Is the higher return on stocks surprising? Why or why not?

-

Howshould goals and objectives be written?

-

On January 2, 2013, the Cerritos Band acquires sound equipment for concert performances at a cost of $ 65,800. The band estimates it will use this equipment for four years, during which time it...

-

A company's gross profit is equal to revenues minus operating expenses. True or False.

-

Find two examples of ads that are designed to arouse consumer needs and discuss their effectiveness.

-

The most recent financial statements for Alexander Co. are shown here: Assets and costs are proportional to sales. The company maintains a constant 40 percent dividend payout ratio and a constant...

-

If A7X Co. has an ROA of 7.6 percent and a payout ratio of 25 percent, what is its internal growth rate?

-

A solid sphere of radius a and dielectric constant r has a uniform volume charge density of o . (a) At the center of the sphere, show that (b) Find the potential at the surface of the sphere. V = Pa...

-

A 10 mm thick steel plate with dimensions of 10 x 10 cm and a density of 7.85 g/cm was submerged in seawater for a period of 1 year. During this period the weight of the plate reduced by 20 grams. Kw...

-

Consider the function f(x1,x2) = x 5x1x2 + 6x at the point x = (0, 2) and search direction p = (1, 1). 1. Write down the first-order Taylor approximation to f(x + ap), where a is the step size. 2....

-

Nike Company has hired a consultant to propose a way to increase the company\'s revenues. The consultant has evaluated two mutually exclusive projects with the following information provided for...

-

What are the most effective way to manage routine and catastrophic disasters, and are they different?

-

The Wall Street Journal reported that of taxpayers with adjusted gross incomes between and itemized deductions on their federal income tax return. The mean amount of deductions for this population of...

-

If P(A) = 0.7, P(B) = 0.6, and A and Bare independent, find P(A and B).

-

Find the inverse, if it exists, for the matrix. -1

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Could a companys cash flow to stockholders be negative in a given year? Explain how this might come about. What about cash flow to creditors?

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App