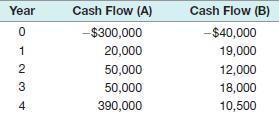

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you require a 15

Question:

Consider the following two mutually exclusive projects:

Whichever project you choose, if any, you require a 15 percent return on your investment.

a. If you apply the payback criterion, which investment will you choose? Why?

b. If you apply the discounted payback criterion, which investment will you choose? Why?

c. If you apply the NPV criterion, which investment will you choose? Why?

d. If you apply the IRR criterion, which investment will you choose? Why?

e. If you apply the profitability index criterion, which investment will you choose? Why?

f. Based on your answers in (a) through (e), which project will you finally choose? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of corporate finance

ISBN: 978-0073382395

9th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Question Posted: