In each of the following cases, calculate the accounting break even and the cash breakeven points. Ignore

Question:

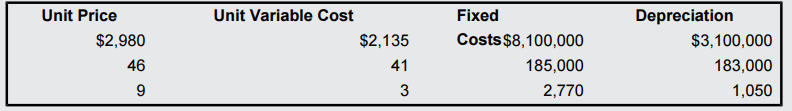

In each of the following cases, calculate the accounting break even and the cash breakeven points. Ignore any tax effects in calculating the cash break-even.

Unit Variable Cost $2,135 Depreciation Unit Price Fixed Costs$8,100,000 $2,980 46 $3,100,000 41 185,000 2,770 183,000 1,050

Step by Step Answer:

The cash breakeven equation is Q C FCP v And the a...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

In each of the following cases, find the unknown variable: Unit Variable Cost Depreciation Accounting Break-Even 125,736 165,000 Unit Price Fixed Costs $39 $30 $ 820,000 27 2,320,000 $975,000 92...

-

You are considering a new product launch. The project will cost $1,950,000, have a four-year life, and have no salvage value ; depreciation is straight-line to zero. Sales are projected at 210 units...

-

Youve observed the following returns on Crash-n-Burn Computers stock over the past five years: 8 percent, 15 percent, 19 percent, 31 percent, and 21 percent. What was the arithmetic average return on...

-

Estimate the moment of inertia of a bicycle wheel.

-

Given a, b, c R, what choice of d will cause this matrix to have the rank of one? d)

-

Using a 4-bit counter with parallel load as in Fig. 2-11 and a 4-bit adder as in Fig. 4-6, draw a block diagram that shows how to implement the following statements: x :R1R1 + R2 Add R2 to R1 x'y...

-

Prepare fund financial statements for the general fund. AppendixLO1

-

The cash account for Bonita Medical Co. at September 30, 2008, indicated a balance of $5,335.30. The bank statement indicated a balance of $5,604.60 on September 30, 2008. Comparing the bank...

-

Allison Corporation acquired all of the outstanding voting stock of Mathias, Inc., on January 1 , 2 0 2 0 , in exchange for $ 6 , 3 8 7 , 5 0 0 in cash. Allison intends to maintain Mathias as a...

-

Petrol is collected for Indian Oil Corporation for sales from nearest 'n' storage points to the Collection point. Given the amount of petrol from 'n' storage points in liters(L) and milli liters...

-

We are evaluating a project that costs $786,000, has an eight year life, and has no salvage value . Assume that depreciation is straight-line to zero over the life of the project. Sales are projected...

-

A project has the following estimated data: Price = $62 per unit; variable costs = $28 per unit; fixed costs = $27,300; required return = 12 percent; initial investment = $34,800; life = four years....

-

Explain the relationship between marketing research and the marketing concept.

-

4. Write short notes on Wiener Filtering.

-

1.Explain Histogram processing

-

2. Explain Spatial Filtering ?

-

3. Explain the Geometric Transformations used in image restoration. 4.Describe homomorphic filtering

-

5.Explain the different Noise Distribution in detail. UNIT I V 1. What is segmentation? 2. Write the applications of segmentation. 3. What are the three types of discontinuity in digital image? 4....

-

The data shown in the following table and stored in Solar Power represent the yearly a mount of solar power generated by utilities (in millions of kWh) in the United States from 2002 through 2018: a....

-

List four items of financial information you consider to be important to a manager of a business that has been operating for a year.

-

Arithmetic and Geometric Returns A stock has had the following year-end prices and dividends: What are the arithmetic and geometric returns for the stock?

-

Using Return Distributions suppose the returns on long-term corporate bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these...

-

Using Return Distributions assuming that the returns from holding small company stocks are normally distributed, what is the approximate probability that your money will double in value in a single...

-

Calculate the current ratio and the quick ratio for the following partial financial statement for Tootsie Roll Note: Round your answers to the nearest hundredth

-

Required information Skip to question [ The following information applies to the questions displayed below. ] Golden Corporation's current year income statement, comparative balance sheets, and...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

Study smarter with the SolutionInn App