In the previous problem, suppose Knox has announced it is going to repurchase $12,600 worth of stock.

Question:

In the previous problem, suppose Knox has announced it is going to repurchase $12,600 worth of stock. What effect will this transaction have on the equity of the firm? How many shares will be outstanding? What will the price per share be after the repurchase? Ignoring tax effects, show how the share repurchase is effectively the same as a cash dividend.

Data from previous problem

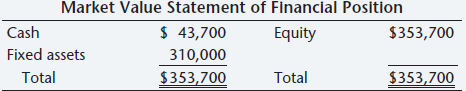

The statement of financial position for Knox Corp. is shown here in market value terms. There are 9,000 shares of stock outstanding.

Market Value Statement of Financial Position $ 43,700 Cash $353,700 Equity Fixed assets Total 310,000 Total $353,700 $353,700

Step by Step Answer:

Repurchasing the shares will reduce cash and shareholders equ...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Related Video

Constant Growth Dividend Discount Model – This dividend discount model assumes dividends grow at a fixed percentage. They are not variable and are consistent throughout. Variable Growth Dividend Discount Model or Non-Constant Growth model

Students also viewed these Business questions

-

In the previous problem, suppose the company has announced it is going to repurchase $18,000 worth of stock instead of paying a dividend. What effect will this transaction have on the equity of the...

-

Share Repurchase in the previous problem, suppose apply Pie has announced it is going to repurchase $6,000 worth of stock. What effects will this transaction have on the equity of the firm? How many...

-

In the previous problem, suppose the company has announced it is going to repurchase $38,500 worth of stock instead of paying a dividend. What effect will this transaction have on the equity of the...

-

To save for her newborn son's college education, Lea Wilson will invest $1,000 at the beginning of each year for the next 18 years. The interest rate is 12 percent. What is the future value? 1)...

-

An analysis of the Marketable Securities control account of Prosper Products, Inc., shows the following entries during the year: Balance, Jan. 1. . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Suppose that the Markov chain in Exercise 3 starts at state 1. How many steps will the chain take on average before absorption? Data From Exercise 3 In Exercises 13, find the fundamental matrix of...

-

4. Pop Corporation owns a 40 percent interest in Son Products acquired several years ago at book value. Sons income statement contains the following information (in thousands): Income from continuing...

-

The shelf supports the electric motor which has mass m 1 and mass center at Gm. The platform upon which it rests has mass m 2 and mass center at Gp. Assuming that a single bolt B holds the shelf up...

-

Question: A and B were carrying on business sharing profits and losses equally. The firms financial position as at 31/ 12/ 2020 was: TZS '000 TZS '000 Assets Liabilities Stocks 60,000 Sundry...

-

Choose one (1) and only one of the following four 2 assignment options. Provide your response back in this document, and SUBMIT it back using Google Classroom once completed. Instructions: 1:...

-

York University pays no taxes on its capital gains or on its dividend income and interest income. Would it be irrational to find low-dividend, high-growth stocks in its portfolio? Would it be...

-

The company with the common equity accounts shown here has declared a 15 percent stock dividend when the market value of its stock is $43 per share. What effects on the equity accounts will the...

-

Assume that for the system of Fig. 7-1, the system closed-loop transfer-function pole p1 is repeated such that the system characteristic equation is given by Fig. 7-1 (z P) (2 Pr + 1)( Pr + 2)(2 Pn)...

-

Question 4 [25 marks] A cantilever beam AB is fixed to a wall and is subjected to concentrated and distributed loads as shown in figure B1. a) Draw the free-body diagram of the problem. [5 marks] a)...

-

GMC is an Australian farm machinery manufacturer, operating since 1975. The company makes high-quality farm machinery and equipment including a range of slashers, mowers, aerators, mulchers and...

-

f. The coordinates of two points A and B are (1, 2) and (5,7) respectively. Find the equation and slope of the line AB. g. Find the rate of change of the area of a circle w.r.t its radius r when r =...

-

1. Sketch the anticipated pattern of cracks on the beam structure shown below. Assume that the structure is adequately reinforced for the load shown, and that the loads are large enough to cause...

-

Estimate the hydrogen consumption required to completely remove the sulfur from a hydrotreater feedstock and to reduce the nitrogen content of the product to 15 ppm by weight. The 48.5 API naphtha...

-

Problem refer to the following graph of y = f(x): Identify the intervals on which f(x) > 0. fx) a d e

-

Rewrite Programming Exercise 7.5 using streams. Display the numbers in increasing order. Data from Programming Exercise 7.5 Write a program that reads in 10 numbers and displays the number of...

-

Using weighted average Delay a mail-order firm processes 4,500 checks per month. Of these, 60 percent are for $50 and 40 percent are for $70. The $50 checks are delayed two days on average; the $70...

-

Value of Lockboxes paper submarine Manufacturing is investigating a lockbox system to reduce its collection time. It has determined the following. The total collection time will be reduced by three...

-

Lockboxes and Collection it takes Cookie Cutter Modular Homes, Inc., about six days to receive and deposit checks from customers. Cookie Cutters management is considering a lockbox system to reduce...

-

44. Dryer Companys policy is to keep 25% of the next month's sales in ending inventory. If Dryer meets its ending inventory policy at the end of April and sales are expected to be 24,000 units in May...

-

What general conclusions can you draw about your companys liquidity, solvency and productivity based on your ratio calculations. Working Capital 2017 = $9,994 M 2016 = $10,673 M Current Ratio 2017 =...

-

Tami Tyler opened Tami's Creations, Incorporated, a small manufacturing company, at the beginning of the year. Getting the company through its first quarter of operations placed a considerable strain...

Study smarter with the SolutionInn App