It is 2024 and Pork Barrels Inc. is considering construction of a new barrel plant in Spain.

Question:

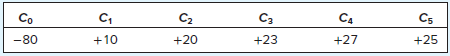

It is 2024 and Pork Barrels Inc. is considering construction of a new barrel plant in Spain. The forecast cash flows in millions of euros are as follows:

The spot exchange rate is USD1.2 = EUR1. The interest rate in the United States is 8%, and the euro interest rate is 6%. You can assume that pork barrel production is effectively risk-free.

a. Calculate the NPV in euros of the cash flows from the project. What is the NPV of the project in dollars?

b. What are the dollar cash flows from the project if the company hedges against exchange rate changes?

c. Suppose that the company expects the euro to depreciate by 5% a year. Does this make the project less attractive?

d. Suppose that Pork Barrels decides to go ahead with the project despite its concerns about the euro. Would the company do better to finance it by borrowing the present value of the project in euros or in dollars?

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus