Manz Property Management Company announced that in the year ended June 30, 2017, its earnings before taxes

Question:

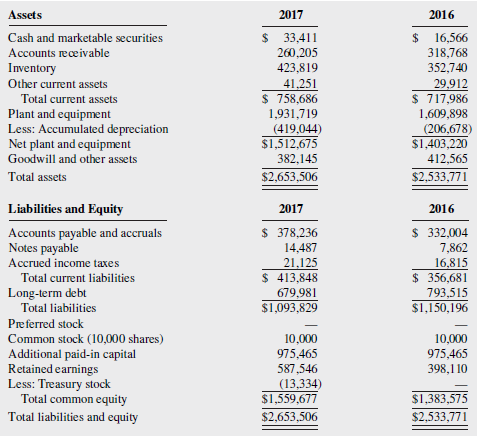

Assets 2017 2016 $ 33,411 16,566 318,768 352,740 Cash and marketable securities %24 Accounts receivable 260,205 Inventory 423,819 41,251 $ 758,686 Other current assets 29,912 $ 717,986 Total current assets Plant and equipment Less: Accumulated depreciation Net plant and equipment Goodwill and other assets 1,931,719 (419,044) $1,512,675 1,609,898 (206,678) $1,403,220 412,565 382,145 $2,653,506 $2,533,771 Total assets Liabilities and Equity 2017 2016 $ 378,236 14,487 $ 332,004 7,862 16,815 $ 356,681 Accounts payable and accruals Notes payable Accrued income taxes 21,125 $ 413,848 679,981 $1,093,829 Total current liabilities Long-term debt Total liabilities 793,515 $1,150,196 Preferred stock 10,000 Common stock (10,000 shares) 10,000 975,465 398,1 10 Additional paid-in capital Retained earnings Less: Treasury stock Total common equity 975,465 587,546 (13,334) $1,559,677 $1,383,575 Total liabilities and equity $2,653,506 $2,533,771

Step by Step Answer:

Earnings before tax 1478936 Tax rate Income Tax 15 ...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The financial statements for the year ended June 30, 2011, are given below for Morgan Construction Company. The firms sales are projected to grow at a rate of 25 percent next year, and all financial...

-

The year ended June 30, 2016, has been another successful year for Koebel's Family Bakery Ltd. The success, however, has meant that Natalie, Daniel, Janet, and Brian have spent many long hours in the...

-

The year ended June 30, 2019, has been another successful year for ABC. The success, however, has meant that Doug, Bev, Emily, and Daniel have spent many long hours in the business accommodating...

-

Steve is a member of a local church. May he deduct as a charitable contribution the commuting expenses for the Sundays that he is assigned to usher?

-

At the close of each day's business, the sales clerks count the cash in their respective cash drawers and compare the total cash to the cash register tapes. They then prepare a cash memo noting any...

-

Draw an electron-dot structure for carbon monoxide, CO.

-

Test your design concepts and ideas you may want to take through to commercialisation. LO.1

-

Georgette Rheingold owns and operates a fruit smoothie manufacturing operation, Nutri-smoothie. She processes fruit and adds it to yogurt and produces fruit smoothies, the main product. She sells the...

-

Under the management Act, auditors are to report any fraud at the company to and the audit committee, and may be eligible for

-

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: 7,400 19,600 Cash Accounts receivable Inventory Building and...

-

Del Bridge Construction had long-term assets before depreciation of $990,560 on December 31, 2016, and $1,211,105 on December 31, 2017. How much cash flow was invested in long-term assets by Del...

-

Nimitz Rental Company provided the following information to its auditors. For the year ended March 31, 2017, the company had revenues of $878,412, general and administrative expenses of $352,666,...

-

As the altitude increases, both the air temperature and the dew point decrease. As long as the air temperature is greater than the dew point, clouds will not form. Typically, the air temperature T...

-

Question 2: Response to John Ripley?

-

Prepare a summary of the effects of the "fat tax" on the demand and supply diagram. Ensure you talk about the dead weight loss. PRICE D Tax Revenue S P1 P2 TAX P3 Dead Weight Loss QUANTITY QeAT QeBT...

-

Trade causes production in Home to move from point A to point B. What does this mean happened to the relative price of Qc? QF Home QF1 A QF2 Qc Qc2 Qc2

-

Write as an ordered pair the coordinates of the point whose y-coordinate is 3 and whose x-coordinate is -7. X Viewing Saved Work Revert to Last Response

-

1. A cereal manufacturer tests their equipment weekly to be assured that the proper amount of cereal is in each box of cereal. The company wants to see if the amount differs from the stated amount on...

-

At one level, the requirement that all firms in an industry be involved in a tacit collusion strategy in order for that strategy to be viable seems to contradict the rareness and imitability...

-

Identify the tax issues or problems suggested by the following situations. State each issue as a question. Jennifer did not file a tax return for 2007 because she honestly believed that no tax was...

-

Would our goal of maximizing the value of the stock be different if we were thinking about financial management in a foreign country? Why or why not?

-

Would our goal of maximizing the value of the stock be different if we were thinking about financial management in a foreign country? Why or why not?

-

Suppose you own stock in a company. The current price per share is $25. Another company has just announced that it wants to buy your company and will pay $35 per share to acquire all the outstanding...

-

Each week you must submit an annotated bibliography. Entries of current events relating to the economic concepts and the impact on the company or the industry of your company. You must use acceptable...

-

Fluffy Toys Ltd produces stuffed toys and provided you with the following information for the month ended August 2020 Opening WIP Units 5,393 units Units Started and Completed 24,731 units Closing...

-

Part A Equipment 1,035,328 is incorrect Installation 44,672 is incorrect Anything boxed in red is incorrect sents 043/1 Question 9 View Policies Show Attempt History Current Attempt in Progress...

Study smarter with the SolutionInn App