Portfolios with more than one asset: Given the returns and probabilities for the three possible states listed

Question:

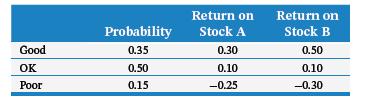

Portfolios with more than one asset: Given the returns and probabilities for the three possible states listed below, calculate the covariance between the returns of Stock A and Stock B. For convenience, assume that the expected returns of Stock A and Stock B are 11.75 percent and 18 percent, respectively.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781119795438

5th Edition

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

Question Posted: