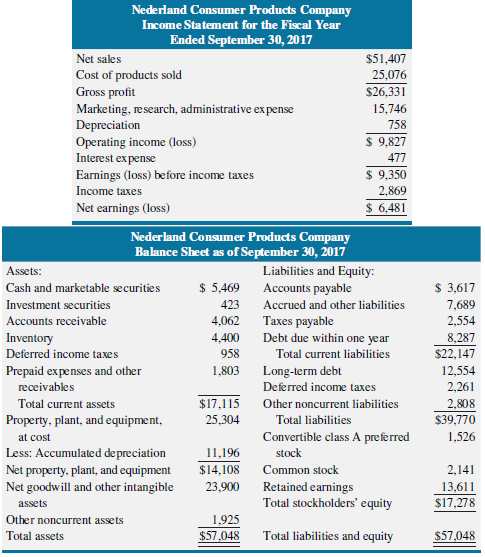

The following are the financial statements for Nederland Consumer Products Company for the fiscal year ended September

Question:

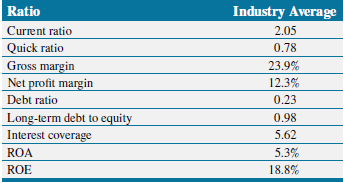

Calculate all the ratios, for which industry figures are available below, for Nederland and compare the firm€™s ratios with the industry ratios.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Nederland Consumer Products Company Income Statement for the Fiscal Year Ended September 30, 2017 $51,407 Net sales Cost of products sold Gross profit Marketing, research, administrative expense Depreciation 25,076 $26,331 15,746 758 $ 9,827 Operating income (loss) Interest ex pense 477 $ 9,350 2,869 Earnings (loss) before income taxes Income taxes $ 6,481 Net earnings (loss) Nederland Consumer Products Company Balance Sheet as of September 30, 2017 Liabilities and Equity: Assets: $ 5,469 $ 3,617 Cash and marketable securities Accounts payable Investment securities 423 Accrued and other liabilities 7,689 Accounts receivable 4,062 Taxes payable Debt due within one year 2,554 8,287 $22,147 Inventory 4,400 958 Deferred income taxes Total current liabilities 1,803 12,554 Prepaid expenses and other receivables Long-term debt Deferred income taxes 2,261 Total current assets $17,115 Other noncurrent liabilities 2,808 Property, plant, and equipment, 25,304 Total liabilities $39,770 Convertible class A preferred 1,526 at cost Less: Accumulated depreciation Net property, plant, and equipment Net goodwill and other intangible 11,196 $14,108 stock Common stock 2,141 Retained earnings Total stockholders' equity 23,900 13,611 $17,278 assets Other noncurrent assets 1,925 Total liabilities and equity $57,048 Total assets $57,048 Ratio Industry Average Current ratio 2,05 Quick ratio 0.78 Gross margin Net profit margin 23.9% 12.3% Debt ratio 0.23 Long-term debt to equity Interest coverage 0.98 5.62 ROA 5.3% ROE 18.8%

Step by Step Answer:

Ratio Industry Average Nederland Current rat...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2007: Notes to Financial Statements: 1. Long-Term Lease. Under the terms of a 5-year...

-

Following are the financial statements for the Chenhai Manufacturing Corporation for 2009 and 2010. The venture is in financial distress and hopes to turn around its financial performance in the near...

-

The following are the financial statements issued by Allen Corporation for its fiscal year ended October 31, 2016: Statement of Retained Earnings For the Fiscal Year Ended October 31, 2016 Retained...

-

5) Pablo Escobar has recently opened a slipper sandal Shop in Brisbane, Australia, a store that specializes in fashionable sleeper sandals. Pablo has just received a degree in business and he is...

-

Using transactions listed in P4-1, indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. P4-1 The following selected...

-

How could you use IR spectroscopy to distinguish between the isomers 1-hexyne and 1,3-hexadiene?

-

Would you let us know what has been your biggest achievement as a communications manager? LO.1

-

Manceville Air has just produced the first unit of a large industrial compressor that incorporated new technology in the control circuits and a new internal venting system. The first unit took 112...

-

E-Eyes.com has a new issue of preferred stock it calls 20/20 preferred. The stock will pay a $20 dividend per year, but the first dividend will not be paid until 20 years from today. If you require a...

-

Bill rides the subway at a cost of 75 cents per trip, but would switch if the price were any higher. His only alternative is a bus that takes five minutes longer, but costs only 50 cents. He makes 10...

-

For the year ended June 30, 2017, Northern Clothing Company has total assets of $87,631,181, ROA of 11.67 percent, ROE of 21.19 percent, and a net profit margin of 11.59 percent. What are the...

-

Modern Appliances Corporation has reported its financial results for the year ended December 31, 2017. Using the information from the financial statements, complete a comprehensive ratio analysis for...

-

When does price discrimination violate antitrust laws?

-

In the introduction to "The Five Sexes," Anne Fausto-Sterling writes that she had to "invent conventions - s/he and his/her - to denote someone who is clearly neither male nor female or who is...

-

Select a product described as one of the "Biggest Product Flops" of 2019 that you will bring back to the market. To, you will need to engage in some research to understand why the product failed to...

-

Breaking the Bank Case Questions (video found at: http://www.pbs.org/wgbh/pages/frontline/breakingthebank/view/?utm_campaign=viewpage &utm_medium=grid&utm_source=grid) 1) To what extent were the...

-

Please answer in full and write legibly. Suppose Alice has taken 7 classes college, and her current GPA is 3.48 (assume for simplicity that all courses carry the same number of credits). Answer the...

-

F. Explain how to overcome two potential biases (e.g., prejudice, discrimination) using culturally competent strategies that will help improve stakeholder communication. G. Explain how to mitigate...

-

Two coaxial parallel plate discs are situated relative to each other as shown in the sketch. The diameter of the upper plate is 20 cm, and that of the lower plate is 40 cm. The lower plate is...

-

At the beginning of its fiscal year, Lakeside Inc. leased office space to LTT Corporation under a seven-year operating lease agreement. The contract calls for quarterly rent payments of $25,000 each....

-

Industry-Specific Ratios there are many ways of using standardized financial information beyond those discussed in this chapter. The usual goal is to put firms on an equal footing for comparison...

-

Industry-Specific Ratios there are many ways of using standardized financial information beyond those discussed in this chapter. The usual goal is to put firms on an equal footing for comparison...

-

Industry-Specific Ratios there are many ways of using standardized financial information beyond those discussed in this chapter. The usual goal is to put firms on an equal footing for comparison...

-

Columbus Industries makes a product that sells for $37 a unit. The product has a $29 per unit variable cost and total fixed costs of $10,000. At budgeted sales of 1,950 units, the margin of safety...

-

18. Suppose that Maxima shares are selling for $10 per share and you own a call option to buy Maxima shares at $7.50. The intrinsic value of your option is:

-

ABC Insurance Company reported the following information on its accounting statements last year: What was ABC 's expense ratio last year

Study smarter with the SolutionInn App