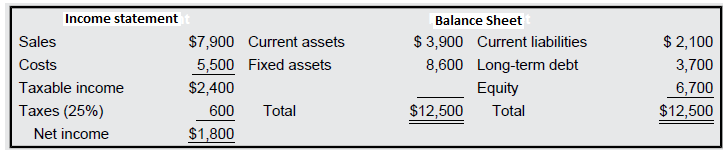

The most recent financial statements for Assouad, Inc., are shown here: Assets, costs, and current liabilities are

Question:

The most recent financial statements for Assouad, Inc., are shown here:

Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. As with every other firm in its industry, next year’s sales are projected to increase by exactly 15 percent. What is the external financing needed?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Question Posted: