The Starlight, Inc., financial statements for the fiscal year ended June 30, 2017, are presented below. The

Question:

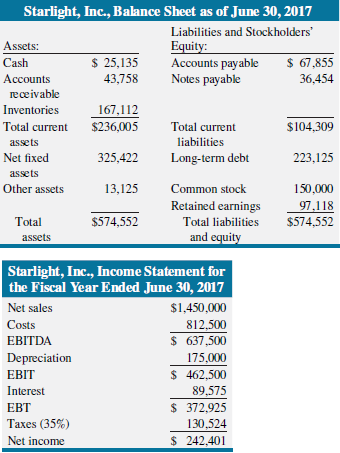

The Starlight, Inc., financial statements for the fiscal year ended June 30, 2017, are presented below. The firm’s sales are projected to grow at a rate of 20 percent next year, and all financial statement accounts will vary directly with sales. Based on that projection, develop a pro forma balance sheet and income statement for the fiscal year ending June 30, 2018.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Starlight, Inc., Balance Sheet as of June 30, 2017 Liabilities and Stockholders' Assets: Equity: Accounts payable Notes payable $ 25,135 $ 67,855 Cash Accounts 36,454 43,758 receivable Inventories 167,112 $236,005 Total current Total current $104,309 liabilities assets Net fixed 325,422 Long-term debt 223,125 assets 150,000 Other assets 13,125 Common stock Retained earnings 97,118 Total $574,552 Total liabilities $574,552 and equity assets Starlight, Inc., Income Statement for the Fiscal Year Ended June 30, 2017 Net sales $1,450,000 Costs 812,500 $ 637,500 EBITDA Depreciation 175,000 $ 462,500 89,575 $ 372,925 EBIT Interest EBT Тахes (35%) 130,524 Net income $ 242,401

Step by Step Answer:

The pro forma statements for Starlight are as follows Starlight Inc ...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The Starlight, Inc. financial statements for the fiscal year ended June 30, 2013, are presented below. The firm's sales are projected to grow at a rate of 20 percent next year, and all financial...

-

A firm chooses to grow at a rate above its sustainable rate. What changes might we expect to see on the firms financial statements in the next year? What changes would result from growing at a rate...

-

A firm's earnings are expected to grow at a rate equal to the required rate of return for its equity, 12 percent. What is the trailing P/E ratio? What is the forward P/E ratio?

-

The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The balance in Prepaid Insurance includes the cost of four months premiums for an insurance policy...

-

After the concert discussed in Problem 2-3 is over and you and your friend are traveling home, you discuss how each of you might otherwise have used the four hours devoted to attending the concert....

-

Determine the missing amount in each of these four separate situations a through d. 1,260 Supplies available-prior year-end 1,200 S 400 $ 3,000 6,500 7,700 Supplies purchased during the current year...

-

Explain various types of organizational cultures.(pp. 470472)

-

A restaurant pays its website developer a monthly fee for hosting and maintaining its web presence. The monthly fee charged by the developer is $400, plus $0.003 per site click. What would be the...

-

Required Information [The following information applies to the questions displayed below] Carmen Camry operates a consulting firm called Help Today, which began operations on December 1 . On December...

-

The chairman of Slack decides that the company should increase the proportion of debt in its capital structure. Currently the company has 10% debt in its capital structure, and an equity beta of 0.8....

-

What is the plug value in a financial model?

-

Northwood Corp. has a dividend payout ratio of 60 percent, return on equity of 14.5 percent, total assets of $11,500,450, and equity of $4,652,125. Calculate the fi rms internal rate of growth (IGR).

-

A spring with a force constant of 120 N/m is used to push a 0.27-kg block of wood against a wall, as shown in FIGURE 6-39. (a) Find the minimum compression of the spring needed to keep the block from...

-

Lennys Limousine Service (LLS) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLS evaluate this project by calculating...

-

Lancer Corp. has the following information available about a potential capital investment Required: 1. Calculate the projects net present value. 2. Without making any calculations, determine whether...

-

Woodchuck Corp. is considering the possibility of outsourcing the production of upholstered chair pads included with some of its wooden chairs. The company has received a bid from Padalong Co. to...

-

Woodchuck Corp. is considering eliminating a product from its line of outdoor tables. Two products, the Oak-A and Fiesta tables, have impressive sales. However, sales for the Studio model have been...

-

Suppose that Flyaway Company also produces the Windy model fan, which currently has a net loss of \($40,000\) as follows: Eliminating the Windy product line would eliminate \($20,000\) of direct...

-

Discuss the significance of the following assumptions in the preparation of an entitys financial statements: (a) Entity assumption (b) Accrual basis assumption (c) Going concern assumption (d) Period...

-

Keating & Partners is a law firm specializing in labour relations and employee-related work. It employs 25 professionals (5 partners and 20 managers) who work directly with its clients. The average...

-

Non constant Growth Storico Co. just paid a dividend of $2.75 per share. The company will increase its dividend by 20 percent next year and will then reduce its dividen4 growth rate by 5 percentage...

-

Non constant Growth this ones a little harder. Suppose the current share price for the firm in the previous problem is S60.98 and all the dividend information remains the same. What required return...

-

Constant Dividend Growth Model Assume a stock has dividends that grow at a constant rate forever. If you value the stock using the constant dividend growth model, how many years worth of dividends...

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

-

Suppose Universal Forests current stock price is $59.00 and it is likely to pay a $0.57 dividend next year. Since analysts estimate Universal Forest will have a 13.8 percent growth rate, what is its...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

Study smarter with the SolutionInn App