Activity-Based Costing in a Nonmanufacturing Environment Cathy, the manager of Cathys Catering, Inc., uses activity-based costing to

Question:

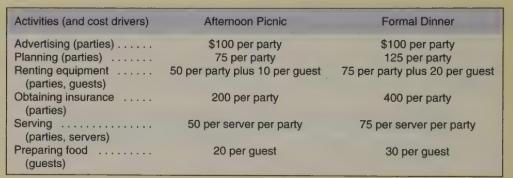

Activity-Based Costing in a Nonmanufacturing Environment Cathy, the manager of Cathy’s Catering, Inc., uses activity-based costing to compute the costs of her catered parties. Each party is limited to 20 guests and requires four people to serve and clean up. Cathy offers two types of parties, an afternoon picnic and an evening formal dinner. The breakdown of the costs follows:

Per party costs do not vary with the number of guests.

Required

a. Compute the cost of a 20-guest afternoon picnic.

b. Compute the cost of a 20-guest evening formal dinner.

c. How much should Cathy charge for each guest for each type of party if she wants to cover her costs?

Step by Step Answer:

Fundamentals Of Cost Accounting

ISBN: 9780073018379

1st Edition

Authors: Michael W Maher, William N. Lanen, Madhav V. Rajan