Glacier Creamery makes and sells ice cream. In developing the operating profit projections, the financial analyst is

Question:

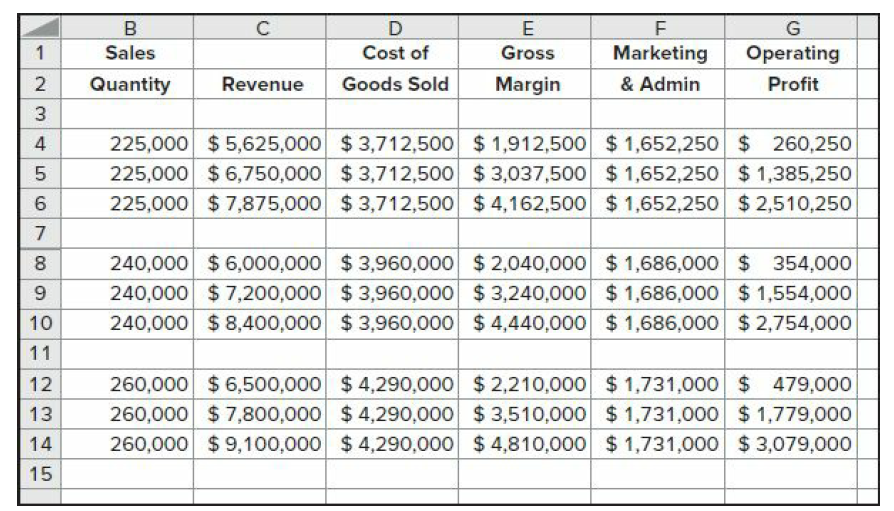

Glacier Creamery makes and sells ice cream. In developing the operating profit projections, the financial analyst is interested in the sensitivity to two parameters: the quantity of ice cream sold, which is related to the average summer temperature, and the variable cost of production, which is related to the prices of the dairy products used in making the ice cream. The experience at Glacier Creamery is that they can expect sales of 400,000 gallons of ice cream plus (minus) an extra 2,000 gallons for every degree the average temperature is above (below) the long-run median temperature of 76 degrees Fahrenheit. For example, if the actual average temperature was 74 degrees, the annual demand would be 396,000 gallons (= 400,000 ? (2,000 ? (74 ? 76)).For the budget year that is approaching, the financial analyst has determined that best estimates of the temperature are 75, 77, and 80 degrees. The best estimates of the variable costs per gallon are $3.00, $3.50, and $4.00. The selling price will be maintained at $6.00 per gallon.

In addition to the variable manufacturing costs noted, the other costs at Glacier are expected to be fixed operating costs of $400,000 plus variable marketing costs of 10 percent of sales revenue.

RequiredUse a spreadsheet to prepare an analysis of the possible operating income for Glacier Creamery, similar to that in?Exhibit 13.15. What is the range of possible operating incomes?

Step by Step Answer:

Fundamentals of Cost Accounting

ISBN: 978-1259969478

6th edition

Authors: William N. Lanen, Shannon Anderson, Michael W Maher