Londen Inc., a division of Englend Enterprises, manufactures Product (A B C) to sell internally to other

Question:

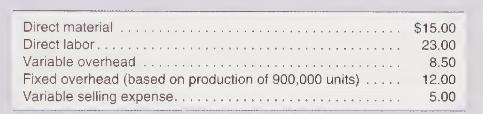

Londen Inc., a division of Englend Enterprises, manufactures Product \(A B C\) to sell internally to other company divisions as well as externally. One unit of Product ABC sells externally for \(\$ 90\). Production and selling costs for a unit of Product ABC follow.

Canterbery Co., another division of Englend Enterprises, wants to purchase 75,000 units of Product \(A B C\) from Londen Inc. during the next year. No selling costs are incurred on internal sales.

a. All the units of Product \(A B C\) that can be produced by Londen Inc. can be sold externally. Assume that Canterbery can purchase Product ABC from other suppliers at a price of \(\$ 95\) to \(\$ 105\). What should the minimum transfer price be?

b. Assume that Londen Inc. is experiencing a slight slowdown in external demand and will be able to sell only 800,000 units of Product ABC externally next year at the \(\$ 90\) selling price. What should be the minimum selling price to Canterbery \(\mathrm{Co}\). under these conditions?

c. Using the information in (a), compute a transfer price that divides the "profit" between the two divisions equally.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9781618533531

10th Edition

Authors: Amie Dragoo, Michael Kinney, Cecily Raiborn