Part One: Backflush Costing Urban Fit Inc. uses backflush costing to account for production costs of its

Question:

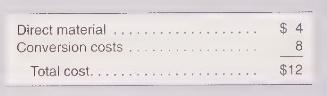

Part One: Backflush Costing Urban Fit Inc. uses backflush costing to account for production costs of its clothing. During June, the company produced 45,000 units and sold 40,000 units. The standard cost for each item is:

The company had no inventory on June 1. The following events took place in June:

- Purchased \(\$ 192,000\) of direct material - Incurred \(\$ 354,000\) of conversion costs - Applied \(\$ 360,000\) of conversion costs to Raw and In-Process Inventory - Finished 45,000 units - Sold 40,000 units for \(\$ 20\) each

a. Prepare journal entries using backflush costing using the method outlined in Exhibit 18.12. Include the entry to close underapplied or overapplied overhead (assumed to be immaterial) to cost of goods sold. Use the following inventory account names: Raw and In-Process Inventory and Finished Goods Inventory.

b. What are the ending balances in the following accounts: Raw and In-Process Inventory, Finished Goods, and Cost of Goods Sold?

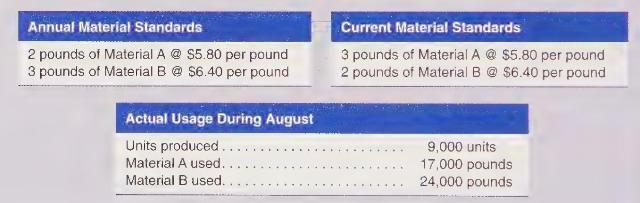

Part Two: JIT Variances New Products Inc. uses a JIT system. The following standards are related to materials \(A\) and \(B\), which are used to make one unit of the company's final product:

Current material standards differ from the original because of an engineering change made near the end of July. Assume all material is acquired at the standard cost per pound.

a. Calculate the material quantity variance

b. Calculate the ECO material variance.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9781618533531

10th Edition

Authors: Amie Dragoo, Michael Kinney, Cecily Raiborn