Refer to the information in Exercise 7-28. Prepare an entry to allocate the under- or overapplied overhead.

Question:

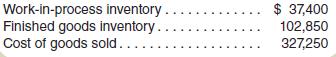

Refer to the information in Exercise 7-28. Prepare an entry to allocate the under- or overapplied overhead. Overhead applied in each of the inventory accounts is as follows:

Data From Exercise 7-28:

Southern Rim Parts estimates its manufacturing overhead to be $495,000 and its direct labor costs to be $900,000 for year 1. The first three jobs that Southern Rim worked on had actual direct labor costs of $20,000 for Job 301, $30,000 for Job 302, and $40,000 for Job 303. For the year, actual manufacturing overhead was $479,000 and total direct labor cost was $850,000. Manufacturing overhead is applied to jobs on the basis of direct labor costs using predetermined rates.

Step by Step Answer:

Fundamentals of Cost Accounting

ISBN: 978-1259565403

5th edition

Authors: William Lanen, Shannon Anderson, Michael Maher