26. A division of Conoco-Phillips is involved in their periodic capital budgeting activity and the engineering and

Question:

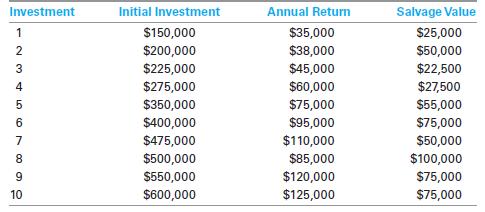

26. A division of Conoco-Phillips is involved in their periodic capital budgeting activity and the engineering and operations staffs have identifi ed ten divisible investments with cash fl ow parameters shown below. Conoco-Phillips uses a 10-year planning horizon and a MARR of 10% in evaluating such investments.

The division’s capital limit for this budgeting cycle is $2,500,000.

a. Determine the optimum portfolio, including which investments are fully or partially (if partial, give percentage) selected. You may use Excel®;

do not use SOLVER.

b. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. Use Excel®

and SOLVER.

c. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current MARR, (2) plus 20%, and (3) minus 20%. Use Excel® and SOLVER.

d. Determine the optimum investment portfolio and its PW when investments 1 through 5 are divisible and investments 6 through 10 are indivisible.

Use Excel® and SOLVER.

e. Determine the optimum investment portfolio and its PW when investments 1 through 5 are indivisible and investments 6 through 10 are divisible.

Use Excel® and SOLVER.

f. Determine the optimum investment portfolio and its PW when: investments 1, 3, and 5 are mutually exclusive; making any investment in 4 is contingent on either investment 2 or investment 5 being fully or partially funded; at least fi ve investments must be made, albeit partially; investments 1 through 5 are indivisible and investments 6 through 10 are divisible.

Use Excel® and SOLVER.

Step by Step Answer:

Fundamentals Of Engineering Economic Analysis

ISBN: 9781118414705

1st Edition

Authors: John A. White, Kellie S. Grasman, Kenneth E. Case, Kim LaScola Needy, David B. Pratt