Consider Problem 11.22. Determine the riskadjusted discount rate at which the project breaks even. Data From Problem

Question:

Data From Problem 11.22

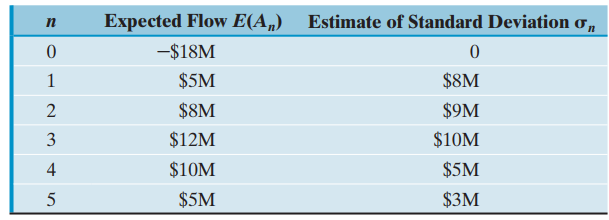

A consumer electronics firm is trying to decide whether to invest $18M in a new plant for expanding its output of cell phones. Management forecasts that the new expansion will generate incremental net cash flows over the next five years as follows:

(a) If the firm€™s discount rate is 12%, determine the mean and variance of the NPW.

(b) If all annual cash flows are normally distributed with the means and variances as previously specified, compute the probability that the project will lose money.

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: