Analyzing the Accounts The controller for Kim Sales Inc. provides the following information on transactions that occurred

Question:

Analyzing the Accounts The controller for Kim Sales Inc. provides the following information on transactions that occurred during the year:

a. Purchased supplies on credit, \(\$ 28,400\)

b. Paid \(\$ 24,600\) cash toward the purchase in transaction \(a\)

c. Provided services to customers on credit, \(\$ 41,800\)

d. Collected \(\$ 33,650\) cash from accounts receivable

e. Recorded depreciation expense, \(\$ 10,350\)

f. Employee salaries accrued, \(\$ 16,200\)

g. Paid \(\$ 16,200\) cash to employees for salaries earned h. Accrued interest expense of \(\$ 1,400\) on long-term debt.

i. Paid a total of \(\$ 15,000\) on long-term debt, which includes \(\$ 1,400\) interest from transaction \(h\)

j. Paid \(\$ 1,850\) cash for one year's insurance coverage in advance k. Recognized insurance expense, \(\$ 1,125\), that was paid in a previous period 1. Sold equipment with a book value of \(\$ 5,700\) for \(\$ 5,700\) cash m. Declared cash dividend, \(\$ 10,000\)

n. Paid cash dividend declared in transaction \(m\)

o. Purchased new equipment for \(\$ 24,300\)

p. Issued common shares for \(\$ 50,000\) cash q. Used \(\$ 18,100\) of supplies to produce revenues Kim Sales uses the indirect method to prepare its statement of cash flows.

\section*{Required:}

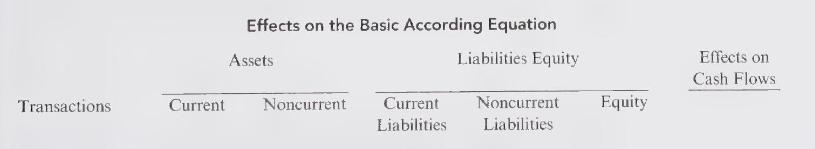

1. Construct a table similar to the one shown below. Analyze each transaction and indicate its effect on the basic accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign \((+)\) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign \((-)\) in the appropriate column.

2. Indicate whether each transaction results in a cash inflow or a cash outflow in the "Effect on Cash Flows" column. If the transaction has no effect on cash flow, indicate this by placing "none" in the "Effect on Cash Flows" column.

3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, a cash flow from investing activities, or a cash flow from financing activities. If there is no effect on cash flows, indicate this as a noncash activity.

Exercise

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone