Assume Deloitte & Touche, the accounting firm, advises Pappadeaux Seafood that Pappadeaux's financial statements must be changed

Question:

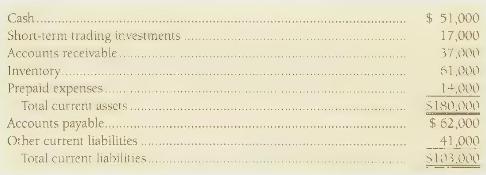

Assume Deloitte \& Touche, the accounting firm, advises Pappadeaux Seafood that Pappadeaux's financial statements must be changed to conform to IFRS. At December 31, 2020, Pappadeaux's accounts include the following:

Deloitte \& Touche advised Pappadeaux that - Cash includes \(\$ 20,000\) that is deposited in a restricted account that is tied up until 2022.

- Pappadeaux did not estimate their uncollectible accounts but rather wrotethem off when they found out that the customer could not pay them. During 2020, Pappadeaux wrote off bad receivables of \(\$ 7,000\). Deloitte \& Touche determines that bad debt expense for the year should be for 2020 should be \(\$ 15,000\) based on the allowance method.

- Pappadeaux reported net income of \(\$ 92,000\) in 2020.

{Requirements}

1. Restate Pappadeaux's current accounts to conform to IFRS.

2. Using the facts provided, calculate the information that is relevant to determining the liquidity of the company before and after the corrections.

3. Determine Pappadeaux's correct net income for 2020.

4. How does using the allowance method to estimate uncollectible accounts benefit the investors and creditors?

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin