At the beginning of the year, Oak mountain Company bought three used machines from Canadian Manufacturing, Inc.

Question:

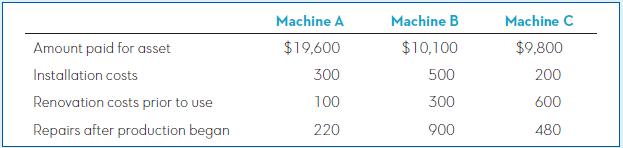

At the beginning of the year, Oak mountain Company bought three used machines from Canadian Manufacturing, Inc. The machines immediately were overhauled, installed, and started operating. Because the machines were different from each other, each was recorded separately in the accounts.

By the end of the first year, each machine had been operating 4,000 hours.

Required:

1. Compute the cost of each machine. Explain the rationale for capitalizing or expensing the various costs.

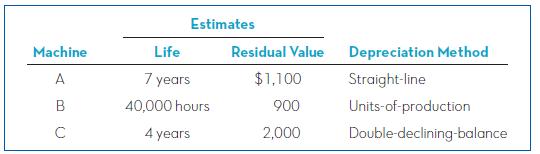

2. Give the journal entry to record depreciation expense at the end of year 1, assuming the following

Amount paid for asset Installation costs Renovation costs prior to use Repairs after production began Machine A $19,600 300 1.00 220 Machine B $10,100 500 300 900 Machine C $9,800 200 600 480

Step by Step Answer:

1 Cost of each machine Machine A B C Total Purchase price 19600 10100 9800 39500 Installation costs ...View the full answer

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

At the beginning of the year, Labenski Inc. bought three used machines from Moore Corporation. The machines immediately were overhauled, installed, and started operating. The machines were different;...

-

At the beginning of the year, Young Company bought three used machines from Vince, Inc. The machines immediately were overhauled, were installed, and started operating. Because the machines were...

-

At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the...

-

from the given option three are similar to each other becausethey follow the same patter identify the option that is dissimilarto the other three A. BCED B. EFhG c. KLNM D. RSVT

-

Infants have high levels of ketone bodies in their blood and abundant 3-ketoacyl-CoA transferase in their tissues (except in liver) prior to weaning. What nutritional advantage does this confer?

-

Downstream Sales P Company owns 80% of the outstanding stock of S Company. During 2004, S Company reported net income of $525,000 and declared no dividends. At the end of the year, S Companys...

-

Can your hometown be classified as a tourist destination? Using the information from this chapter as a guideline, prepare a list of all of the attractions and activities that would appeal to...

-

JWG Company publishes Creative Crosswords. Last year the book of puzzles sold for $10 with variable operating cost per book of $8 and fixed operating costs of $40,000. How many books must JWG sell...

-

Option pricing is an important subject in the field of financial investment. Suppose the current price of a stock is $100 per share. Research shows that the spot price will move either up by 8% or...

-

As a group you are the senior teaching staff of a school where each subject department is regarded as a cost centre. The direct costs of each cost centre are teachers salaries, books and worksheets...

-

During 2017, Bhumika Company disposed of two different assets. On January 1, 2017, prior to the assets disposal, the accounts reflected the following: The machines were disposed of in the following...

-

What is the term for recording costs as assets rather than as expenses? Describe how the decision to record costs as assets rather than expenses affects the balance sheet and income statement in the...

-

A line l 1 has equation 5x + 11y 7 = 0 and crosses the x-axis at A. The line l 2 is perpendicular to l 1 and passes through A. a. Find the coordinates of the point A. b. Find the equation of the...

-

Write a program ranges.py in three parts. (Test after each added part.) This problem is not a graphics program. It is just a regular text program to illustrate your understanding of ranges and loops....

-

solve for x 4 . 0 a 2 = 2 . 0 a x

-

BUSINESS SOLUTIONS Comparative Balance Sheets March 3 1 , 2 0 2 2 December 3 1 , 2 0 2 1 Assets Cash $ 8 4 , 7 8 7 $ 5 7 , 8 7 2 Accounts receivable 2 4 , 2 6 7 5 , 0 6 8 Inventory 6 1 4 0 Computer...

-

Solve:z-18=-103.

-

Complete the social penetration exercise and post your reactions in the discussion. PIRATION Purpose: 1. To help you understand the breadth and depth of self-disclosure. 2. To help you see the...

-

Many children have their molars sealed to help prevent cavities. In an experiment, 120 children aged 68 were randomly assigned to a control group, a group in which sealant was applied and reapplied...

-

For what reason might an exporter use standard international trade documentation (letter of credit, draft, order bill of lading) on an intrafirm export to its parent or sister subsidiary?

-

The following accounts are taken from the financial statements of Facebook Inc. at September 30, 2013. (Amounts are in millions.) Accounts Payable.. $ 700 Cash... 3,100 Common Stock 10,400 Equipment....

-

The balance sheet of Mister Ribs Restaurant reports current assets of $ 30,000 and current liabilities of $ 15,000. Calculate and interpret the current ratio. Does it appear likely that Mister Ribs...

-

Refer to M2- 23. Evaluate whether the current ratio of Mister Ribs Restaurant will increase or decrease as a result of the following transactions. Consider each item, (a)-( d), independent of the...

-

Problem 9-5 Total Risk (LG9-3) Rank the following three stocks by their level of total risk, highest to lowest. Rail Haul has an average return of 11 percent and standard deviation of 20 percent. The...

-

Instructions Chart of Accounts UURILIUI LLUI ASSETS REVENUE The cash account for Coastal Bike Co. at October 1, 2099, indicated a balance of $34,800. During October, the total cash deposited was...

-

An employer has 6 employees, all of whom have exceeded the FUTA wage base. If the employer makes total payments to employees of $70,250 and enters $25,000 on line 5 of Form 940, then $__________ is...

Study smarter with the SolutionInn App