Comprehensive Problem: Reviewing the Accounting Cycle} Fodor Freight Service provides delivery of merchandise to retail grocery stores

Question:

Comprehensive Problem: Reviewing the Accounting Cycle}

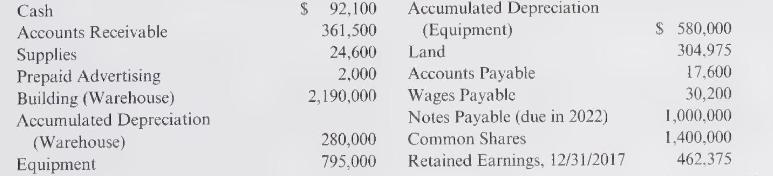

Fodor Freight Service provides delivery of merchandise to retail grocery stores in northern Manitoba. At the beginning of 2018 , the following account balances were available:

During 2018 the following transactions occurred:

a. Fodor performed deliveries for customers, all on credit, for \(\$ 2,256,700\). Fodor also made cash deliveries for \(\$ 686,838\).

b. There remains \(\$ 286,172\) of accounts receivable to be collected at December 31, 2018 .

c. Fodor purchased advertising of \(\$ 138,100\) during 2018 and debited the amount to prepaid advertising.

d. Supplies of \(\$ 27,200\) were purchased on credit and debited to the supplies account.

e. Accounts payable at the beginning of 2018 were paid early in 2018 . There remains \(\$ 5,600\) of accounts payable unpaid at year-end.

f. Wages payable at the beginning of 2018 were paid early in 2018. Wages were earned and paid during 2018 in the amount of \(\$ 666,142\).

g. During the year, Trish Hurd, a principal shareholder, purchased an automobile costing \(\$ 42,000\) for her personal use.

h. One-half year's interest at \(6 \%\) annual rate was paid on the note payable on July 1, 2018 .

i. Property taxes were paid on the land and buildings in the amount of \(\$ 170,000\)

j. Dividends were declared and paid in the amount of \(\$ 25,000\).

The following data are available for adjusting entries:

- Supplies in the amount of \(\$ 13,685\) remained unused at year-end.

- Annual depreciation on the warehouse huilding is \(\$ 70,000\).

- Annual depreciation on the warehouse equipment is \(\$ 145,000\).

- Wages of \(\$ 60,558\) were unrecorded and unpaid at year-end.

- Interest for six months at 6\% per year on the note is unpaid and unrecorded at year-end.

- Advertising of \(\$ 14,874\) remained unused at the end of 2018 .

- Income taxes of \(\$ 482,549\) related to 2018 are unpaid at year-end.

\section*{Required:}

1. Post the 2018 beginning balances to T-accounts. Prepare journal entries for transactions \(a\) through \(j\) and post the journal entries to \(\mathrm{T}\)-accounts, adding any new \(\mathrm{T}\)-accounts you need.

2. Prepare the adjustments and post the adjustments to the T-accounts, adding any new T-accounts you need.

3. Prepare a statement of earnings.

4. Prepare a statement of retained earnings.

5. Prepare a classified statement of financial position.

6. Prepare closing entries.

7. CONCEPTUAL CONNECTION Did you include transaction \(g\) among Fodor's 2018 journal entries? Why or why not?

\section*{Problem

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone