Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Amherst Auto Parts

Question:

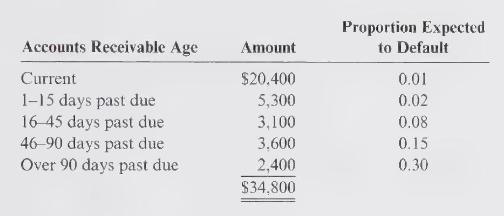

Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Amherst Auto Parts had an accounts receivable balance of \(\$ 31,800\) and a balance in the allowance for doubtful accounts of \(\$ 2,980\) (credit). During the year, Amherst had credit sales of \(\$ 624,300\), collected accounts receivable in the amount of \(\$ 602,700\), wrote off \(\$ 18,600\) of accounts receivable, and had the following data for accounts receivable at the end of the period:

Amherst has a December 31 year-end.

\section*{Required:}

1. Determine the desired postadjustment balance in allowance for doubtful accounts.

2. Determine the preadjustment balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted.

3. Compute bad debt expense.

4. Prepare the adjusting entry to record bad debt expense.

\section*{Problem

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone