Gibson Companys adjusted balances at December 31, 2018 (listed alphabetically), were: Gibson prepared, but did not yet

Question:

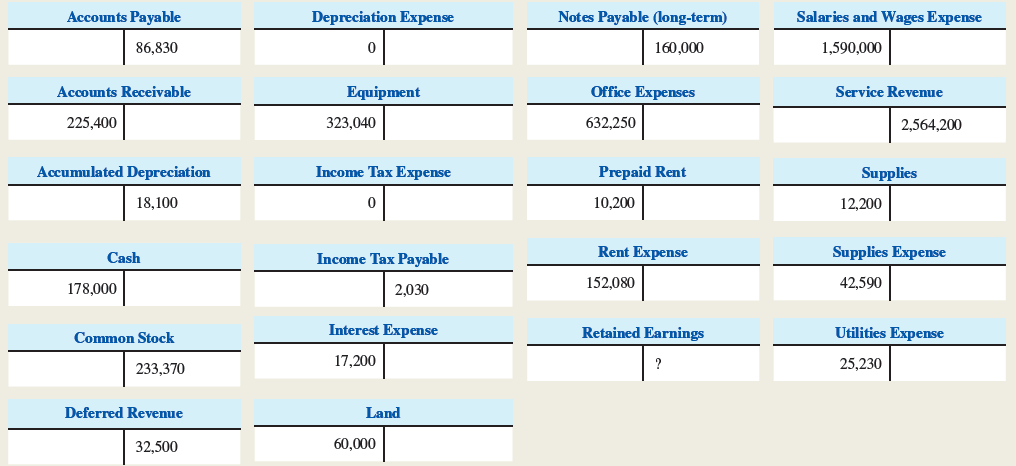

Gibson Company’s adjusted balances at December 31, 2018 (listed alphabetically), were:

Gibson prepared, but did not yet post, additional adjusting journal entries (AJEs) for $3,000 of depreciation and $26,200 of income taxes incurred but not yet paid.

Required:

1. Post the two AJEs, determine the new adjusted balances, and prepare an adjusted trial balance listing the accounts in proper order at December 31, 2018. Solve for the “?” in Retained Earnings.

2. Does the Retained Earnings balance determined in requirement 1 represent the balance at December 31, 2018, or December 31, 2017? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby

Question Posted: