Italian Leather Goods Inc. began 2020 with an inventory of 50,000 units that cost ($ 1,500,000). During

Question:

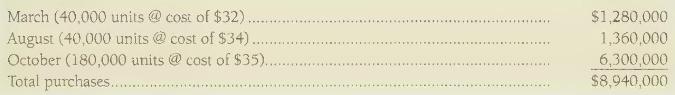

Italian Leather Goods Inc. began 2020 with an inventory of 50,000 units that cost \(\$ 1,500,000\). During the year, the store purchased merchandise on account as follows:

Cash payments on account totalled \(\$ 8,610,000\).

During 2020, the company sold 260,000 units of merchandise for \(\$ 12,900,000\). Cash accounted for \(\$ 4,700,000\) of this; and the balance was on account. Italian Leather Goods uses the FIFO method for inventories.

Operating expenses for the year were \(\$ 2,080,000\). Italian Leather Goods paid \(60 \%\) in cash and accrued the rest as accrued liabilities. The company accrued income tax at the rate of \(32 \%\).

{Requirements}

1. Make summary journal entries to record the Italian Leather Goods transactions for the year ended December 31, 2020. The company uses a perpetual inventory system.

2. Prepare a T-account to show the activity in the Inventory account 3. Prepare the Italian Leather Goods Inc. income statement for the year ended December 31, 2020. Show totals for gross profit, income before tax, and net income.

4. Compute the gross profit percentage. How does this compare with last year's gross profit percentage of \(35 \%\) ? What are some possible reasons for the change?

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin