Journalize the adjusting entry needed on December 31, 2020, the end of the current accounting period, for

Question:

Journalize the adjusting entry needed on December 31, 2020, the end of the current accounting period, for each of the following independent cases affecting Lee Computer Systems Inc. (LCSI). Include explanations for each entry.

a. Each Friday, LCSI pays employees for the current week's work. The amount of the payroll is \(\$ 5,000\) for a five-day work week. The current accounting period ends on Tuesday.

b. LCSI has received notes receivable from some clients for services. During the current year, LCSI has earned accrued interest revenue of \(\$ 1,100\), which will be received next year.

c. The beginning balance of Supplies was \(\$ 1,800\). During the year, LCSI purchased supplies costing \(\$ 12,500\), and at December 31 the inventory of supplies on hand is \(\$ 2,900\).

d. LCSI is developing software for a client and the client paid LCSI \(\$ 20,000\) at the start of the project. LCSI recorded this amount as Unearned Service Revenue. The software development will take several months to complete. LCSI executives estimate that the company has earned three-quarters of the total fee during the current year.

e. Depreciation for the current year includes Computer Equipment, \(\$ 6,300\), and Building, \(\$ 3,700\). Make a compound entry.

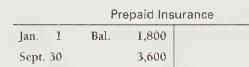

f. Details of Prepaid Insurance are shown in the Prepaid Insurance account. LCSI pays the annual insurance premium (the payment for insurance coverage is called a premium) on September 30 each year. At December 31, nine months of insurance is still prepaid.

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin