Mondeara Clothing prepared its annual financial statements dated December 31. The company used the FIFO inventory costing

Question:

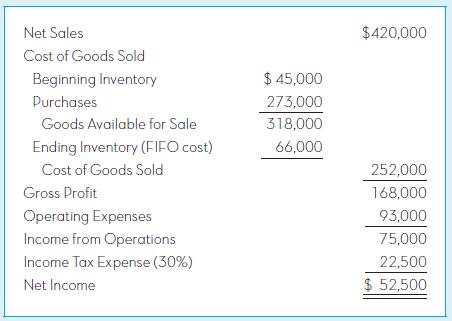

Mondeara Clothing prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to apply LC&NRV to the ending inventory. The preliminary income statement is as follows:

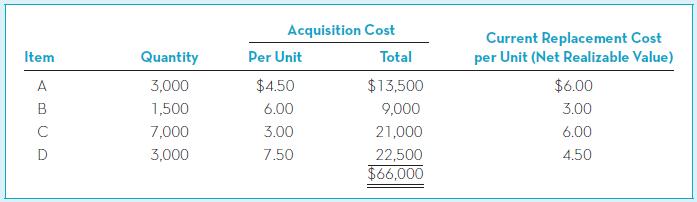

Assume that you have been asked to restate the financial statements to incorporate LC&NRV. You have developed the following data relating to the ending inventory:

Required:

1. Restate the income statement to reflect LC&NRV valuation of the ending inventory. Apply LC&NRV on an item-by-item basis and show your computations.

2. Compare and explain the LC&NRV effect on each amount that was changed in requirement 1.

3. What is the conceptual basis for applying LC&NRV to merchandise inventory?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh