Refer to E9-4. Data From E9-4. Wiater Company operates a small manufacturing facility. On January 1, 2017,

Question:

Refer to E9-4.

Data From E9-4.

Wiater Company operates a small manufacturing facility. On January 1, 2017, an asset account for the company showed the following balances:

Manufacturing equipment...........................$160,000

Accumulated depreciation through 2016.....110,000

During the first week of January 2017, the following expenditures were incurred for repairs and maintenance:

Routine maintenance and repairs on the equipment..............21,000

Major overhaul of the equipment that improved efficiency......$ 1,850

The equipment is being depreciated on a straight-line basis over an estimated life of fifteen years with a $10,000 estimated residual value. The annual accounting period ends on December 31.

Required:

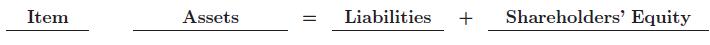

1. Indicate the effects (accounts, amounts, and + or −) of the 2017 adjustment for depreciation of the manufacturing equipment, assuming no change in the estimated life or residual value. Show computations.

2. Give the adjusting entry that should be made at the end of 2017 for depreciation.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh