Snead Company uses the aging method to adjust the allowance for uncollectible accounts at the end of

Question:

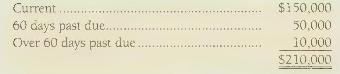

Snead Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. At December 31, 2020, the balance of accounts receivable is \(\$ 210,000\) and the allowance for uncollectible accounts has a credit balance of \(\$ 3,000\) (before adjustment). An analysis of accounts receivable produced the following age groups:

Based on past experience, Snead estimates that the percentages of accounts that will prove to be uncollectible within the three groups are \(2 \%, 8 \%\), and \(20 \%\), respectively. Based on these facts, the adjusting entry for bad debt expense should be made in the amount of

a. \(\$ 3,000\),

b. \(\$ 6,000\).

c. \(\$ 9,000\).

d. \(\$ 13,000\).

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin