You are long 20 November 2015 soybean futures contracts. Calculate your dollar profit or loss from this

Question:

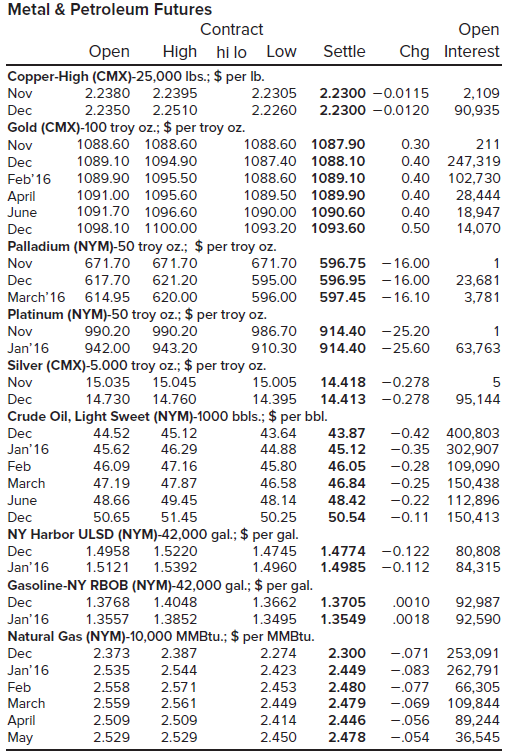

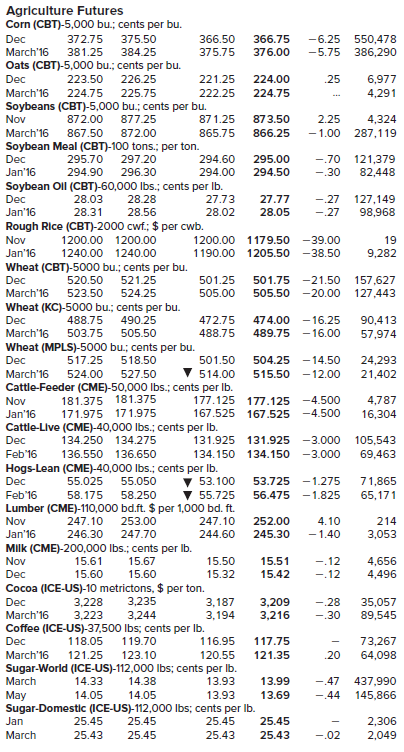

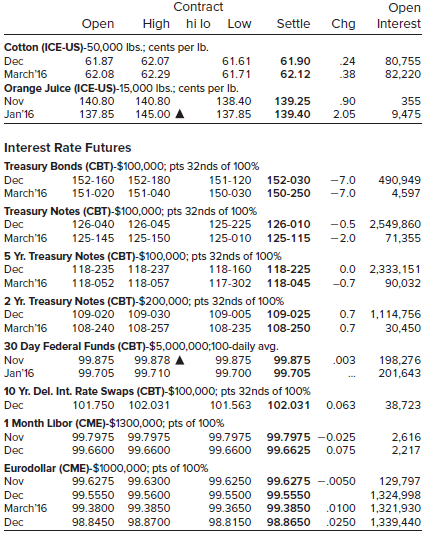

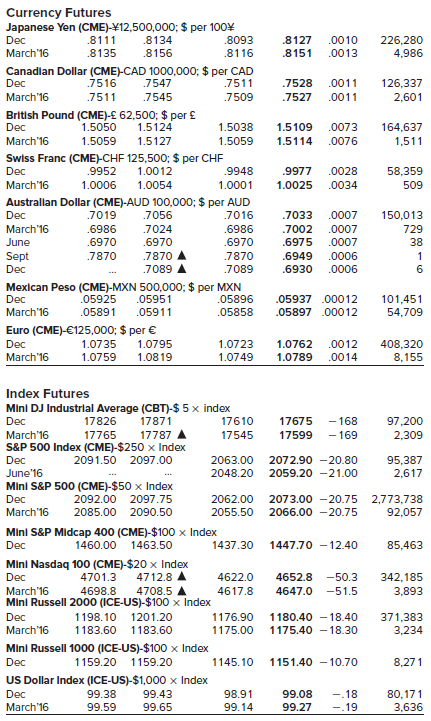

Figure 14.1

Transcribed Image Text:

Metal & Petroleum Futures Contract Open Chg Interest Settle Open High hi lo LoW Copper-High (CMX)-25,000 lbs.; $ per Ib. Nov 2,109 2.2380 2.2395 2.2305 2.2300 -0.0115 Dec 2.2350 2.2510 2.2260 2.2300 -0.0120 90,935 Gold (CMX)-100 troy oz.; $ per troy oz. 1088.60 1088.60 1088.60 1087.90 0.30 211 Nov 1087.40 1088.10 0.40 247,319 1089.10 1094.90 Dec 0.40 102,730 1089.90 1095.50 1088.60 1089.10 Feb'16 April June 1091.00 1095.60 1089.50 1089.90 0.40 28,444 1091.70 1096.60 1090.00 1090.60 0.40 18,947 14,070 1098.10 1100.00 1093.20 1093.60 0.50 Dec Palladium (NYM)-50 troy oz.; $ per troy oz. 671.70 671.70 596.75 - 16.00 Nov 671.70 596.95 - 16.00 Dec 617.70 621.20 595.00 23,681 3,781 596.00 597.45 - 16.10 March' 16 614.95 620.00 Platinum (NYM)-50 troy oz.; $ per troy oz. Nov 986.70 914.40 -25.20 990.20 990.20 Jan'16 942.00 943.20 910.30 914.40 -25.60 63,763 Silver (CMX)-5.000 troy oz.; $ per troy oz. Nov Dec 15.045 15.035 15.005 14.418 -0.278 14.730 14.395 14.760 14.413 -0.278 95,144 Crude Oil, Light Sweet (NYM)-1000 bbls.; $ per bbl. -0.42 400,803 -0.35 302,907 Dec 44.52 45.12 43.64 43.87 45.12 Jan'16 45.62 46.29 44.88 -0.28 109,090 -0.25 150,438 Feb 46.09 47.16 45.80 46.05 March 47.19 47.87 46.58 46.84 48.42 June 48.66 49.45 48.14 -0.22 112,896 50.65 Dec 51.45 50.54 50.25 -0.11 150,413 NY Harbor ULSD (NYM)-42,000 gal.; $ per gal. Dec 1.4958 1.5220 1.4745 1.4774 -0.122 80,808 84,315 1.5392 Jan'16 1.5121 1.4960 1.4985 -0.112 Gasoline-NY RBOB (NYM)-42,000 gal.; $ per gal. Dec .0010 1.3768 1.4048 1.3662 1.3705 92,987 92,590 1.3549 Jan'16 1.3557 1.3852 1.3495 .0018 Natural Gas (NYM)-10,000 MMBtu.; $ per MMBtu. Dec 253,091 2.373 2.387 2.274 2.300 -071 Jan'16 2.535 2.544 2.423 2.449 -.083 262,791 2.558 Feb 2.571 2.453 2.480 -.077 66,305 109,844 March 2.559 2.561 2.449 2.479 -.069 April May 2.509 2.509 2.414 2.446 -.056 89,244 36,545 2.529 2.529 2.450 2.478 -.054 Agriculture Futures Corn (CBT)-5,000 bu.; cents per bu. Dec 372.75 375.50 366.50 366.75 -6.25 550,478 386,290 March'16 381.25 384.25 375.75 376.00 -5.75 Oats (CBT)-5,000 bu.; cents per bu. 226.25 Dec 223.50 221.25 224.00 .25 6,977 March'16 224.75 225.75 222.25 224.75 4,291 Soybeans (CBT)-5,000 bu.; cents per bu. 872.00 Nov 877.25 871.25 865.75 873.50 2.25 4,324 867.50 Soybean Meal (CBT)-100 tons.; per ton. 295.70 294.90 March'16 872.00 866.25 - 1.00 287,119 -.70 -.30 121,379 82,448 Dec 297.20 294.60 295.00 Jan'16 296.30 294.00 294.50 Soybean Oll (CBT)-60,000 Ibs.; cents per Ib. Dec Jan'16 28.03 28.28 27.73 27.77 -27 127,149 98,968 28.31 28.56 28.02 28.05 -27 Rough Rice (CBT)-2000 cwf.; $ per cwb. Nov 1200.00 1200.00 1200.00 1179.50 -39.00 19 Jan'16 1240.00 1240.00 1190.00 1205.50 -38.50 9,282 Wheat (CBT)-5000 bu.; cents per bu. 521.25 157,627 127,443 Dec 520.50 501.25 501.75 -21.50 March'16 523.50 524.25 505.00 505.50 -20.00 Wheat (KC)-5000 bu.; cents per bu. 488.75 Dec 490.25 472.75 474.00 -16.25 90,413 489.75 - 16.00 March'16 Wheat (MPLS)-5000 bu.; cents per bu. Dec 503.75 505.50 488.75 57,974 517.25 518.50 501.50 504.25 -14.50 24,293 March'16 V 514.00 - 12.00 524.00 527.50 515.50 21,402 Cattle-Feeder (CME)-50,000 Ibs.; cents per Ib. 181.375 181.375 171.975 171.975 177.125 177.125 -4.500 167.525 167.525 -4.500 Nov 4,787 Jan'16 16,304 Cattle-Live (CME)-40,000 Ibs.; cents per Ib. Dec 134.250 134.275 131.925 131.925 -3.000 105,543 Feb'16 136.550 136.650 134.150 134.150 -3.000 69,463 Hogs-Lean (CME)-40,000 Ibs.; cents per Ib. 53.100 Dec 55.025 55.050 53.725 -1.275 71,865 v 55.725 Lumber (CME)-110,000 bd.ft. $ per 1,000 bd. ft. Feb'16 58.175 58.250 56.475 -1.825 65,171 Nov 247.10 253.00 247.10 252.00 4.10 214 Jan'16 246.30 247.70 244.60 245.30 - 1.40 3,053 MIlk (CME)-200,000 Ibs.; cents per Ib. Nov 15.61 15.67 15.50 15.51 -.12 -.12 4,656 4,496 Dec 15.60 15.60 15.32 15.42 Cocoa (ICE-US)-10 metrictons, $ per ton. Dec 3,235 3,228 3,223 3,187 3,194 3,209 3,216 -.28 35,057 89,545 March'16 3,244 -.30 Coffee (ICE-US)-37,500 Ibs; cents per Ib. Dec 118.05 119.70 116.95 117.75 73,267 March'16 121.25 123.10 120.55 121.35 .20 64,098 Sugar-World (ICE-US)-112,000 Ibs; cents per Ib. 14.38 March 14.33 13.93 13.99 -47 437,990 May Sugar-Domestlc (ICE-US)-112,000 Ibs; cents per Ib. Jan 14.05 14.05 13.93 13.69 -.44 145,866 25.45 25.45 25.45 25.45 2,306 March 25.43 25.45 25.43 25.43 -.02 2,049

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

The contract set...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

You are short 15 March 2016 corn futures contracts. Calculate your dollar profit or loss from this trading day using Figure 14.1. Figure 14.1 Metal & Petroleum Futures Contract Open Chg Interest...

-

You are short 30 March 2016 five-year Treasury note futures contracts. Calculate your profit or loss from this trading day using Figure 14.1. Figure 14.1 Metal & Petroleum Futures Contract Open Chg...

-

Suppose you buy 15 of the September corn futures contracts at the last price of the day. One month from now, the futures price of this contract is 469'2, and you close out your position. Calculate...

-

Calculate the covariance of returns on the foreign index and the returns on the domestic index. An analyst produces the following joint probability function for a foreign index (FI) and a domestic...

-

If you place a box on an inclined plane, it gains momentum as it slides down. What is responsible for this change in momentum?

-

need one through five please Chapter 4-7 in class assignment-submitted in Canvas 1. The company's bank statement shows a cash balance of $5,000. Comparing the company's cash records with the monthly...

-

Find the probability that a standard normal random variable lies to the left of .67. LO8

-

Consider again Problem 13. The point of purchasing a European option is to limit the risk of a decrease in the per-share price of the stock. Suppose you purchased 200 shares of the stock at $28 per...

-

Suppose that tap dance, Inc.'s capital structure features 60 percent equity, 40 percent debt , and that its before ta cost of a debt is 9 percent, while it cost of equity is 14 percent. Assume the...

-

List the countries your customers come from, sorting the data by Country Name. What problem do you encounter? What would you do to the database to improve your ability to analyze the data by country?

-

In the generalized regression model, suppose that is known. a. What is the covariance matrix of the OLS and GLS estimators of ? b. What is the covariance matrix of the OLS residual vector e = y Xb?...

-

To hedge the foreign exchange risk relative to the Canadian dollar, Jackson should: a. Buy a futures contract to exchange $7,083,333 for C$8.5 million. b. Buy a futures contract to exchange...

-

Modify the drawItalianFlag method in How To 10.1 to draw any flag with three horizontal colored stripes. Write a program that displays the German and Hungarian flags.

-

Financial strength can be defined as the capacity to produce enough cash flows and earnings to pay creditors, investors, and other debts, as well as to cover expenses. Even though sales by themselves...

-

The RMS Titanic was the most technologically advanced liner in the world in the year 1912. At 11:40pm or Sunday, April 14 of that year, the Titanic struck an iceberg and sank in less than three...

-

1. A management consultant is hired by a manufacturing firm to determine the best site for its next production facility. The consultant has had several meetings with the company's senior executives...

-

The figure below shows that a pump is used to transfer water from a reservoir at ground level to a storage take that is elevated. The pump is located 10 ft above the water surface of the reservoir...

-

P6-3 (Algo) Comparing and Contrasting the Effects of Inventory Costing Methods on Financial Statement Elements LO6-2, 6-3 Neverstop Corporation sells item A as part of its product line. Information...

-

In Exercises determine which value best approximates the area of the region between the x-axis and the function over the given interval. (Make your selection on the basis of a sketch of the region...

-

Select a mass spectrometric technique with the highest mass resolution for identifying an unknown compound being eluted from a liquid chromatography column

-

Suppose that there is some certain return I with the same utility as A, i.e., U (A) = U(I ). Also, assume that this certainty equivalent return I is less than the actuarial value of A. What does...

-

Assume that investment A offers the portfolio combination of investment return I 1 with probability (0 < < 1) and investment return I 2 with probability (1 - ). What is the expected utility of...

-

Write the simple return for a stock. Also, write the continuously compounded rate of return. How are these two returns related to one another?

-

Comparing the actual and planned cost of a consulting engagement completed by an engineering firm such as Allied Engineering.

-

What is the NPV of a project that costs $34,000 today and is expected to generate annual cash inflows of $11,000 for the next 7 years, followed by a final inflow of $14,000 in year 8. Cost of capital...

-

help!!! Use the above information to calculate ending inventory using FIFO for a company that uses a perpetua/inventory system

Study smarter with the SolutionInn App