A corporation that does business in the United States must pay federal income taxes based on its

Question:

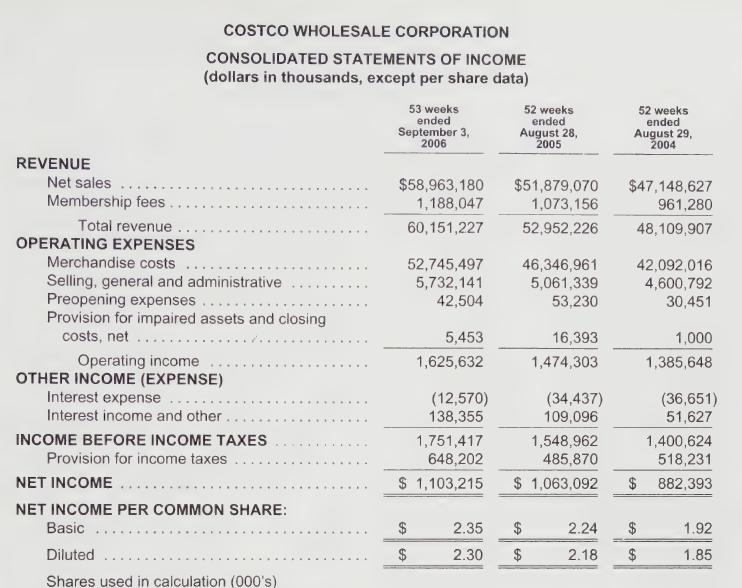

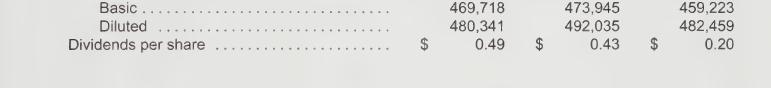

A corporation that does business in the United States must pay federal income taxes based on its amount of net income. The amount of income tax varies from year to year, based on net income, corporate tax brackets, tax legislation, and changing tax regulations. The effective tax rate for a corporation can be calculated by dividing the "provision for income taxes" amount by the "income before income taxes" amount. An awareness of the effective tax rate can help a corporation prepare budgets for future years.

Instructions:

Refer to Costco's Consolidated Statements of Income on page B-7 of Appendix B in this textbook, and complete the following items.

1. List the "provision for income taxes" amounts for the 53 weeks ended September 3, 2006; the 52 weeks ended August 28, 2005; and the 52 weeks ended August 29, 2004.

2. Calculate the effective tax rates for each of the three fiscal years.

3. Determine how much Costco would have paid in federal income taxes in 2004 had the company used the 2005 effective tax rate. What was the amount of tax savings for 2005?

Data from page B-7 of Appendix B

Step by Step Answer: