Question:

A materials purchases journal, a cash payments journal, and a general journal for Vanyo, Inc., a manufacturer of cardboard boxes, are provided in the Working Papers. Work independently to complete the following problem.

Prepare journal entries for each of the following transactions or events.

Transcribed Image Text:

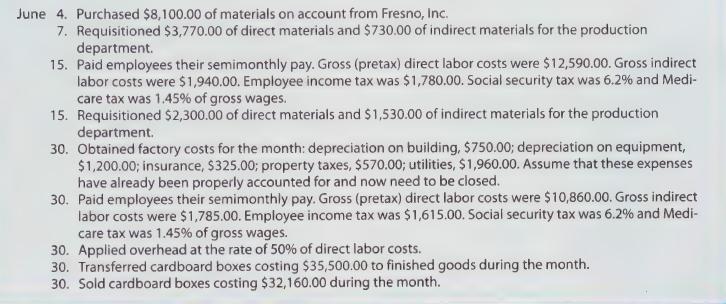

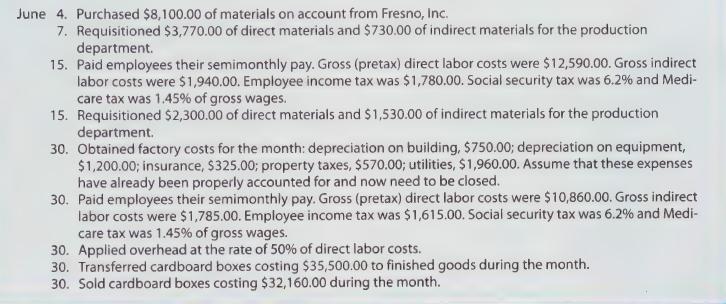

June 4. Purchased $8,100.00 of materials on account from Fresno, Inc. 7. Requisitioned $3,770.00 of direct materials and $730.00 of indirect materials for the production department. 15. Paid employees their semimonthly pay. Gross (pretax) direct labor costs were $12,590.00. Gross indirect labor costs were $1,940.00. Employee income tax was $1,780.00. Social security tax was 6.2% and Medi- care tax was 1.45% of gross wages. 15. Requisitioned $2,300.00 of direct materials and $1,530.00 of indirect materials for the production department. 30. Obtained factory costs for the month: depreciation on building, $750.00; depreciation on equipment, $1,200.00; insurance, $325.00; property taxes, $570.00; utilities, $1,960.00. Assume that these expenses have already been properly accounted for and now need to be closed. 30. Paid employees their semimonthly pay. Gross (pretax) direct labor costs were $10,860.00. Gross indirect labor costs were $1,785.00. Employee income tax was $1,615.00. Social security tax was 6.2% and Medi- care tax was 1.45% of gross wages. 30. Applied overhead at the rate of 50% of direct labor costs. 30. Transferred cardboard boxes costing $35,500.00 to finished goods during the month. 30. Sold cardboard boxes costing $32,160.00 during the month.