An administrative section of the County Assessors Office of Mecklenburg County serves as the billing and collection

Question:

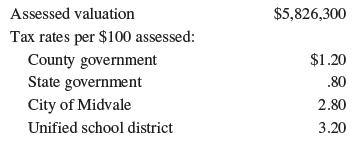

An administrative section of the County Assessor’s Office of Mecklenburg County serves as the billing and collection agency for all property taxes assessed in Mecklenburg County. A charge of 1% of taxes and penalties collected is apportioned among recipients of the taxes for this service. All property tax records—current and delinquent—are maintained in this administrative unit. The 1% charge is included as revenue in the General Fund budget of the county government.

Information relative to the collection of property taxes for fiscal year 2025 is as follows:

Tax bills are issued on January 1; taxes are payable without penalty by April 30; taxes paid after April 30 are subject to a 5% penalty for late payment. Taxes not paid by June 30 are considered delinquent.

No delinquent taxes remain uncollected for years prior to 2025.

An estimated 3% of billed taxes for 2025 will be uncollectible.

A summary of the activities of the Tax Agency Fund for the period January 1, 2025, to June 30, 2025, includes the following:

January 1 Tax bills are mailed to property owners. Accounts are opened by the tax collection unit.

April 30 Taxes collected and deposited during first four months total $372,883. Distribution of taxes collected is made to the applicable governmental units.

June 30 Taxes collected and deposited during May and June including the 5% penalty total $73,412.Distribution of taxes and penalties collected is made to the applicable governmental units.

Required:

A. Prepare in general journal form entries to record the activities of the Tax Agency Fund from January 1 to June 30. Establish a Delinquent Account for taxes not collected.

B. Prepare a balance sheet for the Tax Agency Fund after adjusting the accounts on June 30.

Step by Step Answer: