Bennett acquired 70 percent of Zeigler on June 30, 2010, for $910,000 in cash. Based on Zeiglers

Question:

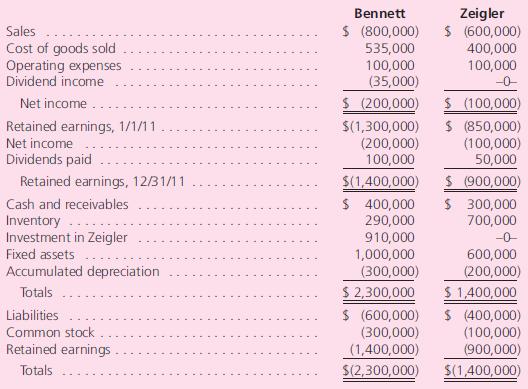

Bennett acquired 70 percent of Zeigler on June 30, 2010, for $910,000 in cash. Based on Zeigler’s acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2011 financial statements are as follows:

Bennett sold Zeigler inventory costing $72,000 during the last six months of 2010 for $120,000.

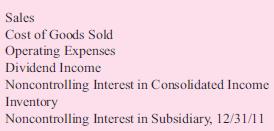

At year-end, 30 percent remained. Bennett sells Zeigler inventory costing $200,000 during 2011 for $250,000. At year-end, 20 percent is left. With these facts, determine the consolidated balances for the accounts:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: