Question:

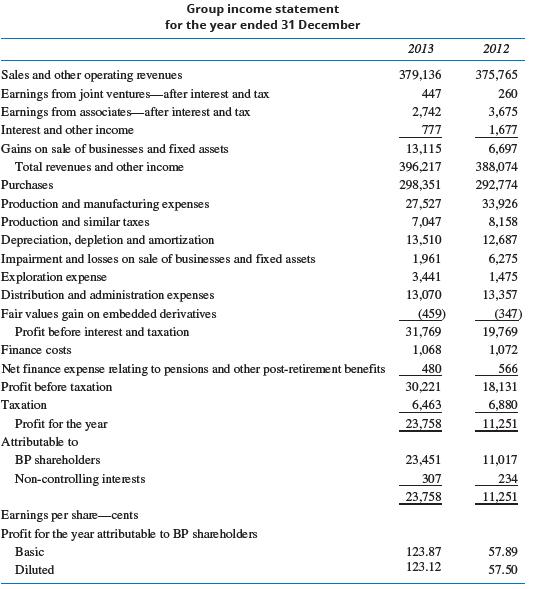

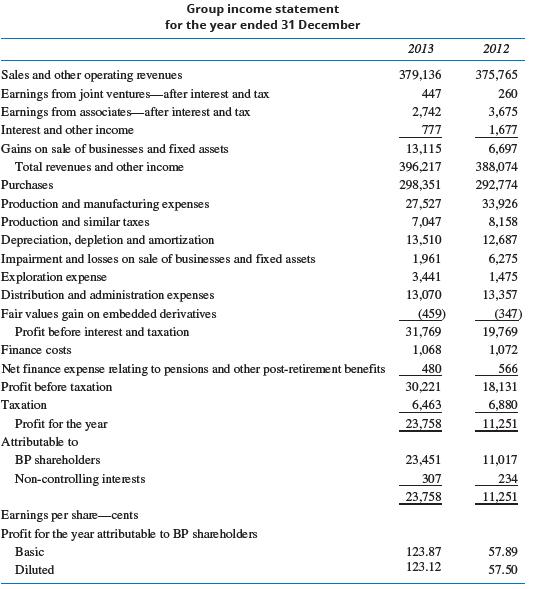

British Petroleum’s income statement was prepared using IFRS is presented below (in $ millions).

Required:

A. Are expenditures reported on BP’s income statement reported by function or by nature of the expense? Be specific. Do you think that this format is more or less useful for users of the financial statements?

B. On the BP income statement, what is the “earnings from associates” usually called in the United States?

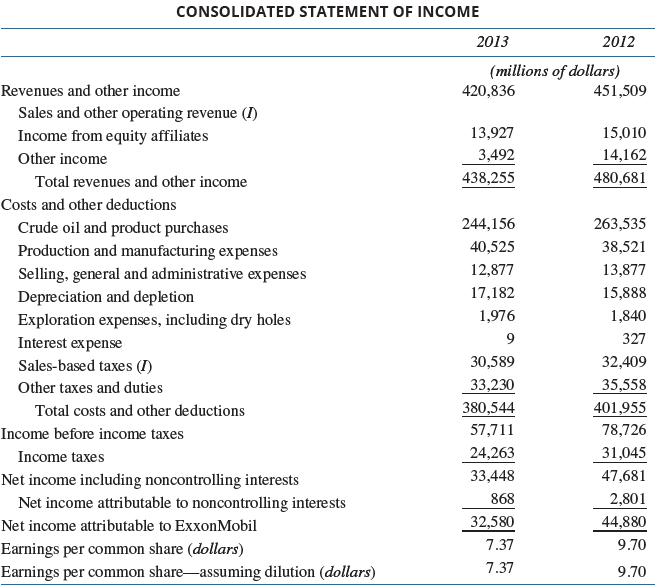

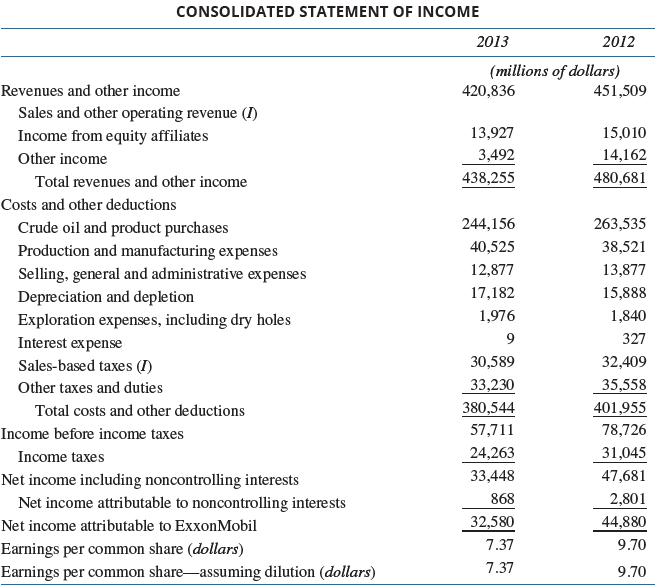

C. On ExxonMobil’s income statement, are the expenses listed by function or by nature?

D. Compare the performance of BP relative to ExxonMobil. Is it easy to compare the numbers from companies using IFRS to companies using U.S. GAAP?

E. Does it matter that BP is using FIFO and ExxonMobil is using LIFO for inventory? The LIFO reserve decreased by $282 million in 2013.

Transcribed Image Text:

Sales and other operating revenues

Earnings from joint ventures after interest and tax

Earnings from associates after interest and tax

Interest and other income

Gains on sale of businesses and fixed assets

Total revenues and other income

Purchases

Production and manufacturing expenses

Production and similar taxes

Depreciation, depletion and amortization

Impairment and losses on sale of businesses and fixed assets

Exploration expense

Distribution and administration expenses

Group income statement

for the year ended 31 December

Fair values gain on embedded derivatives

Profit before interest and taxation

Finance costs

Net finance expense relating to pensions and other post-retirement benefits

Profit before taxation

Taxation

Profit for the year

Attributable to

BP shareholders

Non-controlling interests

Earnings per share-cents

Profit for the year attributable to BP shareholders

Basic

Diluted

2013

379,136

447

2,742

777

13,115

396,217

298,351

27,527

7,047

13,510

1,961

3,441

13,070

(459)

31,769

1,068

480

30,221

6,463

23,758

23,451

307

23,758

123.87

123.12

2012

375,765

260

3,675

1,677

6,697

388,074

292,774

33,926

8,158

12,687

6,275

1,475

13,357

(347)

19,769

1,072

566

18,131

6,880

11,251

11,017

234

11,251

57.89

57.50