Diekmann Company, a U.S.-based company, acquired a 100 percent interest in Rakona A.S. in the Czech Republic

Question:

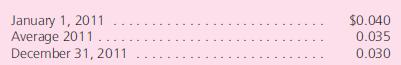

Diekmann Company, a U.S.-based company, acquired a 100 percent interest in Rakona A.S. in the Czech Republic on January 1, 2010, when the exchange rate for the Czech koruna (Kc˘ s) was $0.05.

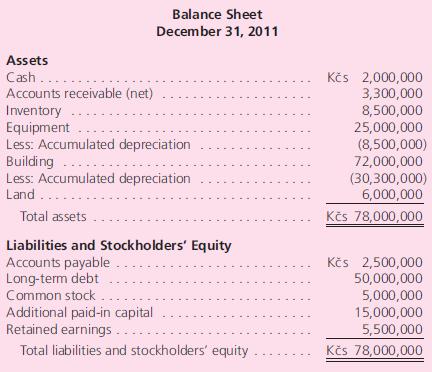

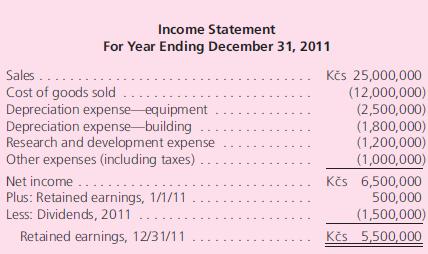

Rakona’s financial statements as of December 31, 2011, two years later, follow:

Additional Information • The January 1, 2011, beginning inventory of Kc˘ s 6,000,000 was acquired on December 18, 2010, when the exchange rate was $0.043. Purchases of inventory were acquired uniformly during 2011.

The December 31, 2011, ending inventory of Kc˘ s 8,500,000 was acquired in the latter part of 2011 when the exchange rate was $0.032. All fixed assets were on the books when the subsidiary was acquired except for Kc˘ s 5,000,000 of equipment acquired on January 3, 2011, when the exchange rate was $0.036, and Kc˘ s 12,000,000 in buildings acquired on March 5, 2011, when the exchange rate was $0.034. Straight-line depreciation is 10 years for equipment and 40 years for buildings. A full year’s depreciation is taken in the year of acquisition.

• Dividends were declared and paid on December 15, 2011, when the exchange rate was $0.031.

• Other exchange rates for 1 Kc˘ s follow:

Part I. Translate the Czech koruna financial statements at December 31, 2011, in the following three situations:

a. The Czech koruna is the functional currency. The December 31, 2010, U.S. dollar–translated balance sheet reported retained earnings of $22,500. The December 31, 2010, cumulative translation adjustment was negative $202,500 (debit balance).

b. The U.S. dollar is the functional currency. The December 31, 2010, Retained Earnings account in U.S. dollars (including a 2010 remeasurement gain) that appeared in Rakona’s remeasured financial statements was $353,000.

c. The U.S. dollar is the functional currency. Rakona has no long-term debt. Instead, it has common stock of Kc˘ s 20,000,000 and additional paid-in capital of Kc˘ s 50,000,000. The December 31, 2010, U.S. dollar–translated balance sheet reported a negative balance in retained earnings of $147,000 (including a 2010 remeasurement loss).

Part II. Explain the positive or negative sign of the translation adjustment in Part I

(a) and explain why a remeasurement gain or loss exists in Parts I

(b) and I(c).

Step by Step Answer: