Goldstein, Inc., has completed its work sheet and financial statements for the fiscal year ending on December

Question:

Goldstein, Inc., has completed its work sheet and financial statements for the fiscal year ending on December 31 of the current year. The income statement for Goldstein is in the Working Papers.

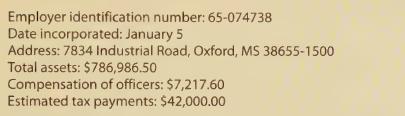

The following information required to prepare the tax return is obtained from company records.

Instructions:

1. Complete the company name and address in the spaces provided on the tax form.

2. Use the information provided to complete lines B—D. Write the amount of compensation of officers on line 12. Write the estimated tax payments on line 32b.

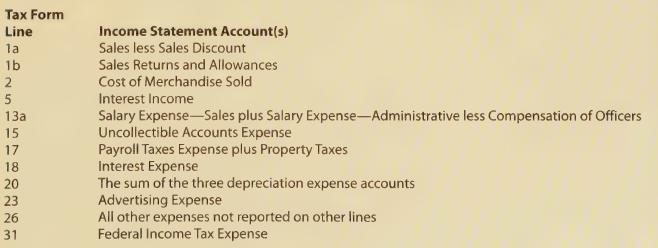

3. Use the amounts on the income statement to complete the following lines of the tax form.

4. Calculate the amounts on lines 1c, 3, 11, 13¢, 21b, 27, 30, 32h, and 34 using the instructions provided on the tax form.

5. Check the accuracy of the completed tax form by comparing the amount on line 30 of the tax form to Net Income before Federal Income Tax on the income statement.

6. Write -0- on the remaining blank lines on the tax form.

Step by Step Answer: