On January 1, 2011, New Tune Company exchanges 15,000 shares of its common stock for all of

Question:

On January 1, 2011, New Tune Company exchanges 15,000 shares of its common stock for all of the outstanding shares of On-the-Go, Inc. Each of New Tune’s shares has a \($4\) par value and a \($50\) fair value.

The fair value of the stock exchanged in the acquisition was considered equal to On-the-Go’s fair value.

New Tune also paid \($25,000\) in stock registration and issuance costs in connection with the merger.

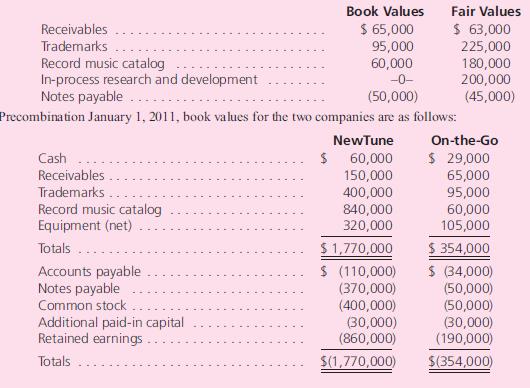

Several of On-the-Go’s accounts have fair values that differ from their book values on this date:

Required:

a. Assume that this combination is a statutory merger so that On-the-Go’s accounts will be transferred to the records of NewTune. On-the-Go will be dissolved and will no longer exist as a legal entity. Using the acquisition method, prepare a postcombination balance sheet for NewTune as of the acquisition date.

b. Assume that no dissolution takes place in connection with this combination. Rather, both companies retain their separate legal identities. Using the acquisition method, prepare a worksheet to consolidate the two companies as of the combination date.

c. How do the balance sheet accounts compare across parts

(a) and (b)?

Step by Step Answer: