On January 2, 2024, Prunce Company acquired 90% of the outstanding common stock of Sun Company for

Question:

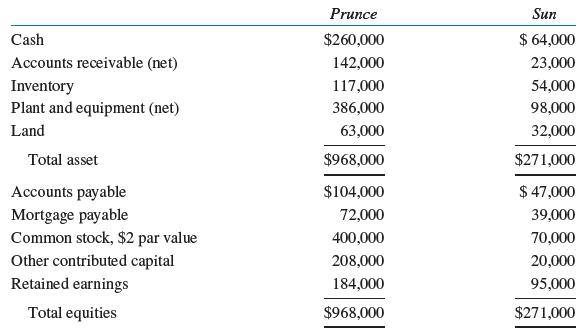

On January 2, 2024, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $192,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows:

The fair values of Sun Company’s assets and liabilities are equal to their book values with the exception of land.

Required:

A. Prepare a journal entry to record the purchase of Sun Company’s common stock.

B. Prepare a consolidated balance sheet at the date of acquisition.

Cash Accounts receivable (net) Inventory Plant and equipment (net) Land Total asset Accounts payable Mortgage payable Common stock, $2 par value Other contributed capital Retained earnings Total equities Prunce $260,000 142,000 117,000 386,000 63,000 $968,000 $104,000 72,000 400,000 208,000 184,000 $968,000 Sun $ 64,000 23,000 54,000 98,000 32,000 $271,000 $ 47,000 39,000 70,000 20,000 95,000 $271,000

Step by Step Answer:

Part A Investment in Sun Company Cash Part B PRUNCE COMPANY AND ...View the full answer

Related Video

This video is about ways to attempt consolidated balance sheet questions. since the unconsolidated financial statements of parent and subsidiary companies are prepared separately, consolidating the balance sheets of both companies is critical and sometimes becomes complex. the tutorial will guide students on to how questions on attempting questions on consolidated financial statements in an easier yet more effective way.

Students also viewed these Business questions

-

On January 2, 2011, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $192,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows:...

-

On January 2, 2014, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $192,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows:...

-

On January 2, 2019, Prunce Company acquired 90% of the outstanding common stock of Sun Company for $192,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows:...

-

John Black is considering to purchasing a land from Real Estate Ltd for $1,000,000. The terms of the agreement are, 10% down payment, and the balance is to be repaid at 20% interest for duration of...

-

Land with an assessed value of $500,000 for property tax purposes is acquired by a business for $600,000. Four years later, the plot of land has an assessed value of $750,000 and the business...

-

What is the atomic number of the as yet undiscovered element in which the 8s and 8p electron energy levels fill? Predict the chemical behavior of this element.

-

Explain international pricing. LO.1

-

Using the following information, compute cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Cash Inflow (Outflow) (a) Cash received...

-

Marvel Parts, Inc., manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in...

-

Continue the situation in Exercise 4- 6 and assume that during 2025 Sales Company earned $190,000 and declared and paid a $50,000 dividend. Required: A. Prepare the investment-related entries on Pert...

-

Pool Company purchased 90% of the outstanding common stock of Spruce Company on December 31, 2024, for cash. At that time the balance sheet of Spruce Company was as follows: Required: Prepare the...

-

An electronic data interchange (EDI) system may present an organization with opportunities and risks. a. What opportunities might an EDI system present? Discuss your answer. b. What risks might an...

-

Question 4 25 p J Mart is considering purchasing a new inventory control system featuring state-of-the-art technology. Two vendors have submitted proposals to supply J Mart with the new system. The...

-

ME 2352 Design Optimization Assignment TWO, due February 6th, 2024, 4:00 pm University of New Brunswick Department of Mechanical Engineering 1. By use of definition of linear dependency determine if:...

-

IKEA's People and Planet Positive sustainability plan, launched in 2012, aims to contribute to a better life for people and a better future for the planet. The plan outlines several sustainable goals...

-

Question 4 [25 marks] A cantilever beam AB is fixed to a wall and is subjected to concentrated and distributed loads as shown in figure B1. a) Draw the free-body diagram of the problem. [5 marks] a)...

-

GMC is an Australian farm machinery manufacturer, operating since 1975. The company makes high-quality farm machinery and equipment including a range of slashers, mowers, aerators, mulchers and...

-

You work for an established production company on the Production Lead Team. Your team consists of talented team members, each with a certain skill to help in the research and operations of a new...

-

Economic feasibility is an important guideline in designing cost accounting systems. Do you agree? Explain.

-

Perke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2020. On this date, the fair value of the assets and liabilities of Superstition Company was equal to...

-

On January 1, 2018, Porter Company purchased an 80% interest in the capital stock of Salem Company for $850,000. At that time, Salem Company had capital stock of $550,000 and retained earnings of...

-

On January 1, 2019, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company?s stockholders? equity consisted of the following: Common...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App