On June 5, 20X3, Fairborn, Inc., purchased a new cutting machine for use in its factory. The

Question:

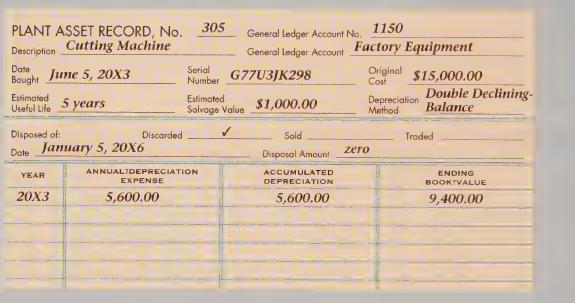

On June 5, 20X3, Fairborn, Inc., purchased a new cutting machine for use in its factory. The machine cost \($15,000.00\) and has an estimated salvage value of \($1,000.00\) and an estimated useful life of five years. Fairborn used the double declining-balance method of depreciation. The bookkeeper prepared the following plant asset record.

Instructions:

1. Find the error in the plant asset record.

2. Write a written explanation of the error to the bookkeeper. In your explanation, give the correct calculation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: